Benchmark Administrators

ESMA is the supervisor of administrators of EU critical benchmarks, and of third-country administrators recognised in the EU. Starting 1 January 2026, ESMA will be the single entry point for all third country benchmarks administrators in the EU, and will be in charge of supervising both third country recognised and endorsed benchmarks. ESMA is also responsible for promoting the consistent implementation of the Benchmarks Regulation across the EU, using a variety of policy tools.

The Benchmarks Regulation aims to protect consumers and investors exposed to benchmarks, thanks to greater transparency and rigorous oversight over the provision of benchmarks in the EU.

The scope of the Benchmarks Regulation is broad. It includes three categories of benchmarks: critical, significant, and non-significant benchmarks, with critical benchmarks subject to stricter rules. The Benchmarks Regulation includes also specific rules for commodity benchmarks and interest rates. In November 2019, two new categories of benchmarks were included: EU Climate Transition and EU Paris-aligned benchmarks.

In May 2025, the amended Benchmarks Regulation was published in the Official Journal. The revised rules aim to strike a balance between reducing the regulatory burden on administrators and users of benchmarks which are non-significant in the EU, while still safeguarding the integrity, robustness and reliability of the benchmarks in scope in order to ensure a high level of consumer and investor protection. Starting January 2026, the scope of the regulation will include only critical or significant benchmarks, as well as EU Climate Transition and EU Paris-aligned benchmarks and certain commodity benchmarks (subject to Annex II of the Regulation).

Benchmarks provided from outside the EU that remain in scope of the Regulation can be offered in the EU market under one of the following BMR regimes for third-country benchmarks: equivalence, recognition or endorsement.

Further to the reduced regulatory scope, the review of the Benchmarks Regulation has also extended ESMA’s supervisory competences. Specifically, in addition to supervising recognition, starting 1 January 2026, ESMA will be in charge of supervising the EU administrator endorsing third country benchmarks, which would result in a single entry point for all third country benchmark administrators in the EU. Moreover, when that endorsing EU administrator provides benchmarks which are in scope of the Regulation, ESMA will also be responsible for the supervision of these benchmarks.

ESMA as supervisor of benchmark administrators

From 1 January 2022, ESMA became the supervisor of the existing administrators of EU critical benchmarks and recognised third-country benchmark administrators. Since 1 January 2022, ESMA is also responsible for authorising any new administrators of EU critical benchmarks and recognising third-country benchmark administrators. ESMA’s supervision for benchmarks administrators is risk-based, outcome-based and data-driven.

Critical benchmarks fall in two categories. Those that are critical across the EU (EU critical benchmarks) or they are critical in one Member State (national critical benchmarks). The list of all critical benchmarks is available here. The national competent authorities are responsible for the supervision of the administrators providing national critical benchmarks in their respective country. ESMA is responsible for the supervision of the EU critical benchmarks. Currently, the only EU critical benchmark is EURIBOR, administered by the European Money Markets Institute (EMMI). In July 2019, EMMI was authorised as administrator of EURIBOR under the Benchmarks Regulation by the Belgian Financial Services and Markets Authority (FSMA). On 1 January 2022, the supervisory responsibilities over EMMI were transferred from the FSMA to ESMA.

ESMA is also responsible for the supervision in the EU of third-country benchmark administrators that are recognised under BMR. You can find in ESMA’s register the list of the administrators and third-country benchmarks that are supervised by ESMA.

Recognition of third-country benchmark administrators

If an administrator, located in a third country, wishes to be recognised in the EU for its benchmarks to be used in the EU, then it has to apply for recognition with ESMA. Article 32 of the Benchmarks Regulation requires the applicant administrator to provide all information necessary to satisfy ESMA that it has established, at the time of recognition, all the necessary arrangements to meet the requirements set out in the Benchmarks Regulation and further specified in Commission Delegated Regulation (EU) 2018/1645.

The specific timeline for the assessment of recognition applications is defined in Article 32(5) of the Benchmarks Regulation.

The form and content of an application for recognition are detailed in the Commission Delegated Regulation (EU) 2018/1645. In order to help firms in the preparation of an application that is both accurate and complete, ESMA makes available an application form to administrators intending to apply for recognition under Article 32 of the Benchmarks Regulation. Before submitting an application for recognition, applicants are strongly encouraged to engage with ESMA as they prepare the necessary documentation for the application. Administrators interested in applying for recognition can reach out to ESMA by email (Supervision-BMR@esma.europa.eu). Such pre-application engagement will in no way prejudice the subsequent submission of the application.

When a third-country benchmark administrator submits an application for recognition to ESMA, ESMA will start its assessment of the administrator’s compliance with the relevant requirements of the Benchmarks Regulation. If an application contains all the necessary information, ESMA will finalise its assessment within 90 working days of receipt of the application.

When ESMA identifies that information is missing in the submitted application, ESMA will request the applicant to provide the missing information within a specified deadline. Applicants should note that the timing of ESMA’s assessment could be impacted when applicants do not provide all necessary information and ESMA needs to request the missing information following the submission of the application. Applicants should also take note that, if they do not provide the requested missing information, ESMA will base its assessment of the application on the information at its disposal, which may be detrimental to ESMA’s ability to conclude positively on the applicant’s compliance with the conditions for recognition.

ESMA charges a fee to applicants for each application for recognition received. ESMA also charges annual supervisory fees to the administrators it supervises. The fee amount is defined in Commission delegated regulation on supervisory fees applicable to benchmark administrators.

Endorsement of third country benchmarks

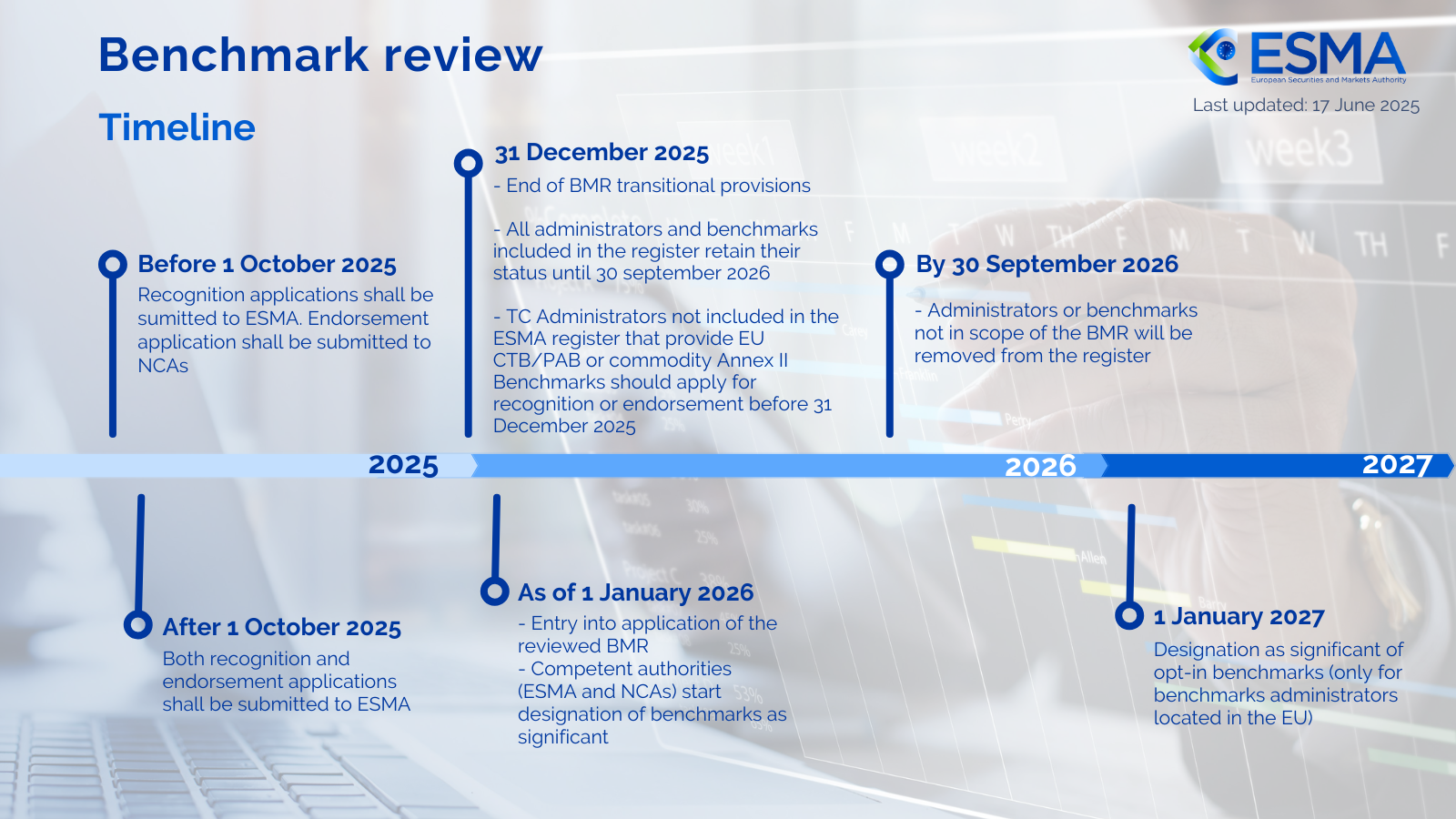

If an administrator, located in the Union and authorised or registered in accordance with Article 34 of the Benchmarks Regulation, wishes to endorse third country benchmarks in scope of the Regulation, then it has to apply for endorsement with ESMA starting 1 October 2025. Before 1 October 2025, endorsement applications should be submitted to National Competent Authorities. Article 33 of the Benchmarks Regulation requires the applicant to provide all information necessary to satisfy ESMA that, at the time of application, all the conditions for endorsement referred to in Article 33(1) of the Benchmarks Regulation are fulfilled.

The specific timelines for both the completeness and the compliance assessments are defined:

- For authorisation or registration applications, in Article 34(5) and Article 34(6) of the Benchmarks Regulation.

- For endorsement applications, in Article 33(3) of the Benchmarks Regulation.

Administrators interested in applying for endorsement can reach out to ESMA by email (Supervision-BMR@esma.europa.eu).

Equivalence - Commission implementing decisions

The equivalence regime applies at jurisdiction level, and it is driven by an assessment by the Commission. When the Commission adopts an equivalence decision, stating that the regulatory framework of a third-country is equivalent to the EU BMR, ESMA establishes cooperation arrangements with the competent authority of that third country. The following are the equivalent decisions adopted by the Commission under BMR and the corresponding cooperation arrangements between ESMA and the third country authorities.

Register

ESMA started publishing a register of administrators and third country benchmarks on 3 January 2018, in accordance with Article 36 of the Benchmarks Regulation (BMR). As of 1 January 2026, the EU Benchmark Register on ESMA’s website will be updated in accordance with Regulation (EU) 2025/914, amending Article 36 of the BMR, to include the following:

- “the identities, including, where available, the legal entity identifier (LEI), of the administrators authorised or registered pursuant to Article 34 and the competent authorities responsible for the supervision thereof;

- the identities, including, where available, the LEI, of administrators that comply with the conditions laid down in Article 30(1), the list of benchmarks, including, where available, their International Securities Identification Numbers (ISINs), referred to in Article 30(1), point (c), and the third country competent authorities responsible for the supervision thereof;

- the identities, including, where available, the LEI, of the administrators that acquired recognition in accordance with Article 32, the list of benchmarks, including, where available, their ISINs, provided by those administrators which may be used in the Union and, where applicable, the third country competent authorities responsible for the supervision thereof;

- the benchmarks, including, where available, their ISINs, that are endorsed in accordance with the procedure laid down in Article 33, the identities of their administrators, and the identities, including, where available, the LEI, of the endorsing administrators;’

- the benchmarks, including, where available, their ISINs, subject to a statement published by ESMA or a competent authority pursuant to Article 24(2), and hyperlinks to such statements;

- the benchmarks, including, where available, their ISINs, subject to designations by competent authorities notified to ESMA pursuant to Article 24(3) or (7), and hyperlinks to such designations;

- the benchmarks, including, where available, their ISINs, subject to designations by ESMA, and hyperlinks to such designations;

- the benchmarks, including, where available, their ISINs, subject to public notices issued by ESMA and competent authorities pursuant to Article 24a(6), and the hyperlinks to such public notices;

- the list of EU Climate Transition Benchmarks and EU Paris-aligned Benchmarks, including, where available, their ISINs, available for use in the Union

- the list of critical benchmarks, including, where available, their ISINs;

- the list of commodity benchmarks subject to Annex II available for use in the Union, including, where available, their ISINs.;”

In addition, according to Article 51(4c), administrators of benchmarks that on 31 December 2025 were included in the register referred to in Article 36 as authorised, registered, recognised or endorsing administrators, shall retain that status until 30 September 2026.

This update ensures that all EU and third-country benchmarks falling under the scope of the BMR will be listed on the ESMA register, with clear indication of whether they are critical, significant, EU Climate Transition Benchmarks, EU Paris Aligned Benchmarks or Commodity Annex II Benchmarks.

Under the amended Benchmarks Regulation, a supervised entity located in the EU may use a benchmark in scope of the BMR if it is included in the ESMA register (notwithstanding the transitional period on third country benchmarks ending 31st December 2025).

Policy work

The Benchmarks Regulation empowered ESMA to develop Regulatory Technical Standards (RTS) and Implementing Technical Standards (ITS). Furthermore, the European Commission requested ESMA to provide technical advice for the adoption of Commission delegated acts. A full overview of the Implementing and Delegated Acts on the Benchmarks Regulation is available here.

ESMA has also used its different policy tools and has already issued guidelines, Q&As, supervisory briefings, and briefings on various topics related to the Benchmarks Regulation, to promote a consistent and convergent application of the requirements across the EU.

List of National Competent Authorities

ESMA publishes a list of National Competent Authorities responsible for carrying out the duties under the Benchmarks Regulation at national level.

Complaints

If you wish to submit a complaint about a Benchmark Administrator, please fill in this form and email it to BMR-info@esma.europa.eu. In the subject of your email, please state "Complaint about a Benchmark Administrator".

If you are a whistleblower, please see the Whistleblower section.

EURIBOR college & Working group on euro risk-free rates

As the supervisor of Euribor administrator, EMMI, ESMA is the Chair of the Euribor College of Supervisors. The College is composed, alongside ESMA, of the national competent authorities responsible for the supervision of the banks contributing to Euribor as well as the national competent authorities of Member States in which Euribor plays a critical role.

Between May 2021 and December 2023, ESMA was the secretariat of the working group on euro risk-free rates. The working group on euro risk-free rates was a private sector working group established in 2017 by ESMA, European Central Bank (ECB), European Commission and the Belgian Financial Services and Markets Authority (FSMA). The working group is now discontinued.

▸ More information in the dedicated section.