Sanctions and Enforcement

As the single supervisor for Credit Rating Agencies (CRAs), Securitisation Repositories (SRs), Trade Repositories registered under EMIR and/or SFTR (TRs), Tier 2 Third-Country Central Counterparties (Tier 2 TC-CCPs), EU Critical Benchmark Administrators and Recognised Third-Country Administrators (Benchmark Administrators) as well as Data Reporting Service Providers (DRSPs) in the EU, ESMA has responsibilities and powers to deal with possible infringements.

ESMA's role

CRAs, SRs, TRs, Tier 2 TC-CCPs, Benchmark Administrators and DRSPs under ESMA’s supervision must comply with the requirements set out in the relevant sectoral legislation and will be liable where they commit infringements specified under that legislation. Part of ESMA’s supervision of such entities involves the investigation of possible infringements and, in appropriate cases, taking enforcement action.

Where ESMA finds an infringement has been committed by CRAs, SRs, TRs, Tier 2 TC-CCPs, Benchmark Administrators or DRSPs, it adopts one or more supervisory measures, which may include: the issuing of a public notice, requiring the supervised entity to bring the infringement to an end, and withdrawing the registration/ recognition of the supervised entity. If ESMA finds that an infringement has been committed negligently or intentionally, it also imposes fines on the entity concerned.

Find out here why is ESMA doing this, who is subject to possible measures, and how are these imposed.

How enforcement works

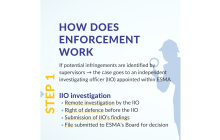

Supervisory investigation

ESMA teams perform supervisory work with the purpose of ensuring that the entities under their supervision comply with the requirements under the applicable legislation. They may for instance request information, examine records and documentation, summon persons and conduct interviews, and inspect CRAs’, TRs’, SRs’, Tier 2 CCPs’, Benchmark Administrators’ or DRSPs’ business premises. Where, as part of their investigations in a given case, ESMA supervisors find serious indications of possible facts liable to constitute infringements of the CRA Regulation, EMIR, SFTR, Securitisation Regulation, BMR or MiFIR, the case is referred for further investigation to an independent investigating officer (‘IIO’) appointed within ESMA.

IIO investigation

The IIO has investigative powers whereby for example s/he may require information and documents, summon and interview persons, and execute on-site inspections. The IIO will make findings as to the commission of infringements and may recommend measures or fines to be imposed for those infringements. The supervised entity will be given the opportunity to make submissions on the IIO’s findings and the IIO will duly consider such submissions before submitting any findings and the file on which they are based to ESMA’s Board of Supervisors.

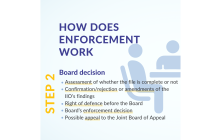

Board decision

On the basis of the file and findings submitted by the IIO, and after having heard the person subject to investigation, the Board of Supervisors independently decides whether any infringements have been committed, adopts appropriate supervisory measures for infringements found, and imposes fines for the infringements that have been found to be committed negligently or intentionally. Where the enforcement case concerns a Tier 2 TC-CCP, the CCP Supervisory Committee prepares the decision to be taken by the Board of Supervisors.

Enforcement actions

2026

| Name | Breach | Fine | Notices/Decisions |

|---|---|---|---|

| REGIS-TR S.A. Trade repository |

Breaches of EMIR and SFTR in relation to adequate policies and procedures, organisational structure, and operational risk, as well as specific requirements related to confidentiality and protection against misuse of information. | €1,374,000 | Public notice 17 February 2026 Decision Press release |

2025

| Name | Breach | Fine | Notices/Decisions |

|---|---|---|---|

| Modefinance Credit Rating Agency |

Breaches of the Credit Rating Agencies Regulation requirement not to use ESMA’s name in such a way that would indicate or suggest endorsement or approval by ESMA of the credit ratings or any credit rating activities of the credit rating agency | €420,000 | Public notice 7 April 2025 Decision Press release |

2024

| Name | Breach | Fine | Notices/Decisions |

|---|---|---|---|

| Scope Ratings GmbH Credit Rating Agency |

Breaches of the Credit Rating Agencies Regulation concerning internal controls, procedures and administrative arrangements, potential conflicts of interest and ancillary services. | €2,197,500 | Public notice_22 March 2024 Decision Press release |

2023

| Name | Breach | Fine | Notices/Decisions |

|---|---|---|---|

| S&P Global Ratings Europe Limited (S&P) Credit Rating Agency |

Breaches of the Credit Rating Agencies Regulation: published credit ratings before the concerned securities were issued by the rated entities and announced to the market. | €1,110,000 | Public notice_24 March 2023 Decision Press release |

2022

| Name | Breach | Fine | Notices/Decisions |

|---|---|---|---|

| REGIS-TR, S.A. Trade Repository |

Breaches of EMIR for not having ensured the integrity of the data reported to it and not providing direct and immediate access to regulators. | €186,000 | Public notice_22 March 2022 Decision Press release |

2021

| Name | Breach | Fine | Notice/Decisions |

|---|---|---|---|

| UnaVista Limited Trade Repository |

Breaches of EMIR for: incorrect field ordering logic, incorrect mapping rules, crossed date boundaries, incorrect or unreliable reports for regulators and not providing regulators with direct and immediate access to trade state reports and historic trade state reports. | €238,500 | Public Notice_21 September Decision Press release |

| DTCC Derivatives Repository Plc Trade Repository |

Breaches of EMIR for: granting certain asset managers access to data that they were not entitled to receive; setting up its IT system in a way which altered the substance of certain information reported to it; and failing to provide regulators with direct and immediate access to relevant data. | €408,000 | Public Notice_8 July Decision Press release |

| Moody’s Investors Service Ltd Credit Rating Agency |

Breaches of the Credit Ratings Agencies Regulation for: in a situation of conflict of interests related to the 10% shareholder threshold, issued new ratings. Failed to properly disclose situations of conflict of interest related to the 5% shareholder threshold. Did not have in place adequate procedures, administrative, appropriate administrative arrangements nor internal control mechanisms to ensure compliance with conflict of interest obligations. | €2,735,000 | Public Notices _23 March 2021 Decision Moody’s UK Press release |

| Moody’s France S.A.S. Moody’s Deutschland GmbH Moody’s Italia S.r.l. Moody’s Investors Service España S.A. |

Breaches of the Credit Ratings Agencies Regulation for: failed to properly disclose situations of conflict of interest related to the 5% shareholder threshold. | €280,000 | Decision Moody’s France |

| €340,000 | Decision Moody’s Germany | ||

| €174,000 | Decision Moody’s Italy | ||

| €174,000 | Decision Moody’s Spain |

2020

| Name | Breach | Fine | Notices/ Decisions |

| Scope Ratings GmbH Credit Rating Agency |

Breaches of the Credit Rating Agencies Regulation in relation to the systematic application of its 2015 Covered Bonds Methodology and its revision. | €640,000 | Public Notice_4 June 2020 Decision The Decision of the Joint Board of Appeal of the European Supervisory Authorities of 28 December 2020 dismissed the appeal lodged by Scope Ratings. Press release |

2019

| Name | Breach | Fine | Notices/ Decisions |

| REGIS-TR Trade Repository |

Breach of EMIR for negligently failing to provide to regulators direct and immediate access to details of derivative contracts. | €56,000 | Public Notice_15 July 2019 Decision Press release |

| Fitch Ratings Ltd. (UK); Fitch France S.A.S.; and Fitch Ratings Espana S.A.U Credit Rating Agency |

Breaches of the Credit Rating Agencies Regulation for: in a situation of conflict of interests related to the 10% shareholder threshold, issued new ratings, failed to immediately assess the need to re-rate or withdraw existing ratings and failed to disclose the conflicts of interest. Did not have in place adequate procedures nor internal control mechanisms to ensure compliance with conflict of interest obligations. | €5,132,500 | Public notices_28 March 2019 Decision Fitch UK Decision Fitch France Decision Fitch Spain Press release |

| Svenska Handelsbanken AB (publ) Credit Rating Agency |

Breach of the Credit Rating Agencies Regulation: issuing credit ratings without being authorised by ESMA. | No fine (public notice only) | Public Notice 11 July 2019 Decision Further to a Decision of the Joint Board of Appeal of the European Supervisory Authorities of 27 February 2019, this decision has been remitted to ESMA’s Board of Supervisors. Amended decision Press release |

| Nordea Bank Abp (publ) Credit Rating Agency |

Breach of the Credit Rating Agencies Regulation: issuing credit ratings without being authorised by ESMA. | No fine (public notice only) | Public Notice 11 July 2019 Decision Further to a Decision of the Joint Board of Appeal of the European Supervisory Authorities of 27 February 2019, this decision has been remitted to ESMA’s Board of Supervisors. Amended decision Press release |

| Skandinaviska Enskilda Banken AB (publ) Credit Rating Agency |

Breach of the Credit Rating Agencies Regulation: issuing credit ratings without being authorised by ESMA. | No fine (public notice only) | Public Notice_11 July 2019 Decision Further to a Decision of the Joint Board of Appeal of the European Supervisory Authorities of 27 February 2019, this decision has been remitted to ESMA’s Board of Supervisors. Amended decision Press release |

| Swedbank AB (publ) Credit Rating Agency |

Breach of the Credit Rating Agencies Regulation: issuing credit ratings without being authorised by ESMA. | No fine (public notice only) | Public Notice_11 July 2019 Decision Further to a Decision of the Joint Board of Appeal of the European Supervisory Authorities of 27 February 2019, this decision has been remitted to ESMA’s Board of Supervisors. Amended decision Press release |

2018

| Name | Breach | Fine | Notices/ Decisions |

| Danske Bank A/S Credit Rating Agency |

Breach of the Credit Rating Agencies Regulation: issuing credit ratings without being authorised by ESMA. | €495,000 | Public Notice_23 July 2018 Decision Press release |

2017

| Name | Breach | Fine | Notices/ Decisions |

| Moody’s Deutschland GmbH; and Moody’s Investors Service Ltd Credit Rating Agency |

Breaches of the Credit Rating Agencies Regulation: ratings Presentation Infringement; and Methodology Disclosure Infringement. |

€1,240,000 | Public Notice_1 June 2017 Decision Press release |

2016

| Name | Breach | Fine | Notices/ Decisions |

| Fitch Ratings Limited Credit Rating Agency |

Breaches of the Credit Rating Agencies Regulation: failed to allow the Republic of Slovenia 12 hours to consider and respond to the downgrade of its sovereign rating; No sound internal controls enabling it to comply with ‘the 12 hour requirement’; and Unauthorised disclosures of new and potential new sovereign ratings before that information was made public. |

€1,380,000 | Public Notice_21 July 2016 Decision Press release |

| DTCC Derivatives Repository Ltd Trade Repository |

Breach of EMIR: failed to allow regulators and supervisors direct and immediate access to the details of derivatives contracts they need to fulfil their responsibilities and mandates. | €64,000 | Public Notice/Decision_23 March 2016 Press release |

2015

| Name | Breach | Fine | Notices/ Decisions |

| DBRS Ratings Limited Credit Rating Agency |

Breaches of the Credit Rating Agencies Regulation: failed to meet the requirements to establish adequate policies and procedures, to establish an effective compliance function, and regarding adequate record keeping. | €30,000 | Public Notice/Decision_29 June 2015 Press release |

2014

| Name | Breach | Fine | Notices/ Decisions |

| Standard & Poor’s Credit Market Services Europe Limited; and Standard & Poor’s Credit Market Services France SAS Credit Rating Agency |

Breaches of the Credit Rating Agencies Regulation: failed to meet the organisational requirements when erroneously suggesting a downgrade of the Republic of France. | No fine (public notice only) | Public Notice/Decision_ 3 June 2014 Press release |

Calculation of fines

When ESMA finds that a Credit Rating Agency, a Trade Repository, a Securitisation Repository or a Third Country-CCP, Benchmarks Administrator or DRSP has negligently or intentionally committed an infringement, the Authority calculates the fines to be imposed using a two-step methodology. This methodology is determined by Article 36a of the CRA Regulation and by Articles 65 and 25j of EMIR and ESMA cannot deviate from it.

The two-step methodology consists of:

- the setting of a basic amount for the fine; and

- the adjustment, if necessary, of that basic amount.

Transparency of decisions

Since 2018, ESMA publishes more extensive and detailed public versions of its enforcement decisions, in order to provide more details on the reasons for its findings. This has a number of benefits, including more legal certainty for entities supervised by ESMA and a better understanding of ESMA’s enforcement role by stakeholders, including CRAs, TRs, SRs, Tier 2 TC-CCPs, Benchmark Administrators, DRSPs, investors and issuers.

The public versions of enforcement decisions need to comply with the applicable rules regarding the protection of professional secrecy and personal data and so may be redacted. For that purpose, a confidentiality check takes place with the entity concerned before publication.