MiFID II and MIFIR review

The adoption of the MiFID II / MiFIR review marks the transition to the revised Single Rulebook for securities markets. Those changes constitute an important step towards the Capital Markets Union (CMU) with more integrated and transparent EU capital markets.

This section centralises the information related to MiFID II / MiFIR review, providing an overview of the amendments and their implications, and also considering that certain elements of the revised rulebook will phase in over the coming years.

The texts of MiFID II / MiFIR review entered into force on 28 March 2024, while the transposition deadline for the MiFID II amendments is set on 29 September 2025. The amendments introduced to Level 1 include a substantial number of Level 2 measures that are to be developed over the next 6 to 18 months. The regulatory changes will also require a number of amendments to the ESMA IT-systems and relevant MIFIR registers.

ESMA, in close coordination with the European Commission (EC), is performing a thorough assessment of the provisions that may merit further guidance and clarification for contributing to a smooth transition of the revised framework. In this context, the EC has published a communication and adopted an interpretative notice on the application of the transitional provision, which has been complemented by an ESMA statement.

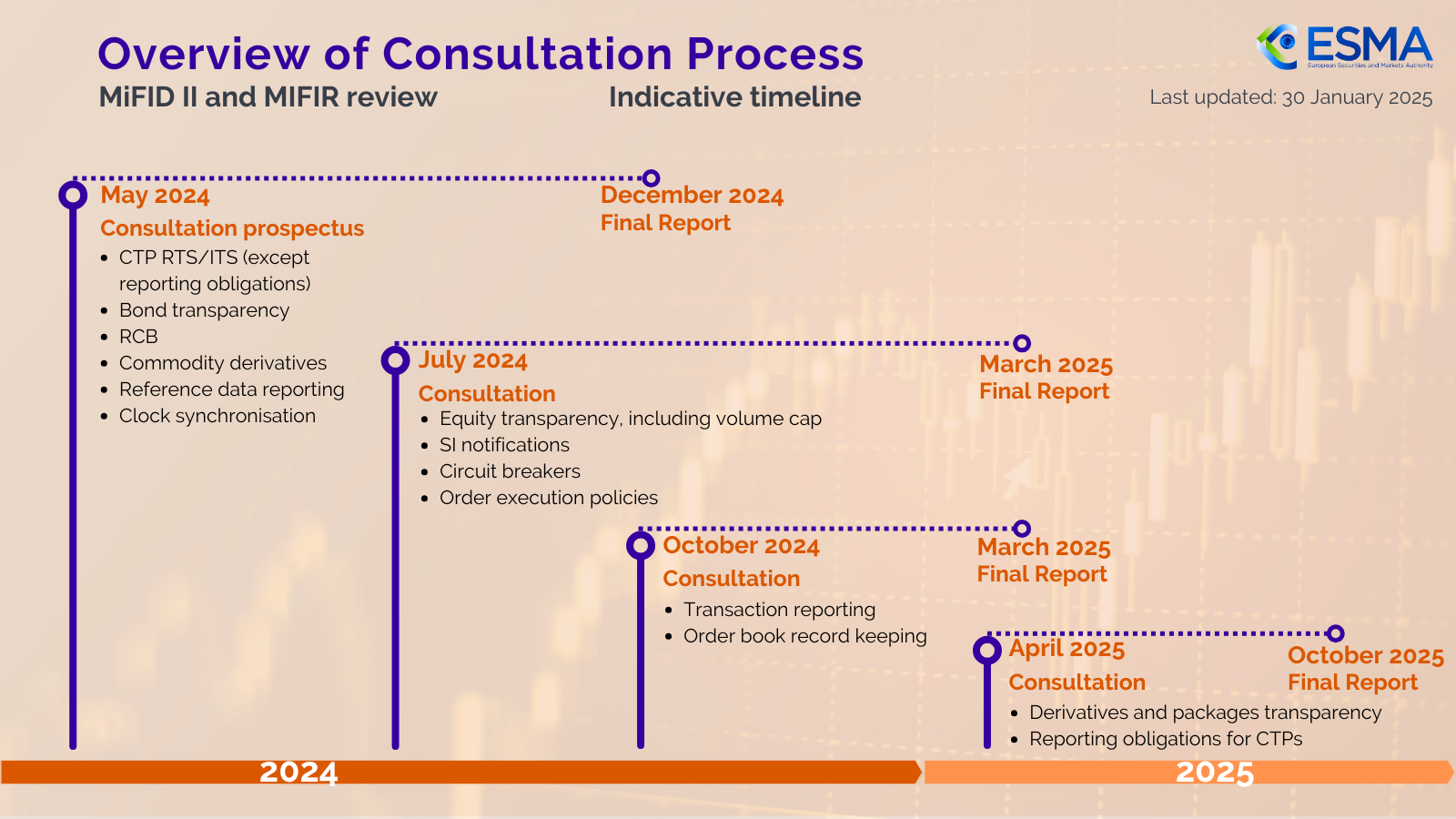

During the implementation phase of MiFID II/MiFIR review, ESMA will be consulting the public on a range of technical standards that will be published sequentially in a number of consolidated consultation paper (CP) packages. The date for the entry into application of the Level 2 measures is subject to their adoption by the European Commission and approval by the European Parliament and the Council of the EU and, where needed, will also provide for an implementation period.

To support stakeholders, considering the complexity of the changes, the phased in application of some amendments and the staggered implementation of IT changes, this webpage centralises the information published in relation to MiFID II/MiFIR review.

Public Statements

- Deprioritisation of supervisory actions on the obligation to publish RTS 28 reports – 13 February 2024

- Transition to the revised MiFIR rulebook – 21 March 2024

- Transition for the application of the MiFID II / MiFIR review – 27 March 2024 | News item: Start of DPE regime on 3 February and end of publication of Systematic Internalisers data - 24 January 2025

- Transition to the new regime for post-trade transparency of OTC-transactions – 22 July 2024

(The current CSV version of the register will be maintained at least until the end of 2026. ESMA will communicate in advance on the planned discontinuation date and the integration of the current register in ESMA’s IT systems.) - Transition for the application of the MiFID II/MiFIR review – No.2 – 10 October 2025

Public Hearings

ESMA is organising an online public hearing on revised rules following the MiFIR review on Friday 28 June 2024. More information is available on this page.

DPE register

The MiFIR review introduced provisions empowering National Competent Authorities (NCAs) to grant the status of Designated Publishing Entity (DPE) to investment firms. According to Article 21a of MiFIR, DPEs, when they are party to a transaction, shall be responsible for making the transaction public through an approved publication arrangement (APA). The Regulation requires ESMA to establish by 29 September 2024 a public register of all DPEs, specifying their identity and the classes of financial instruments for which they act as DPEs.

ESMA has compiled the DPE register, as requested by the revised MiFIR, with information provided by the NCAs. Any change in the register should be requested through the NCA. The current CSV version of the register will be maintained at least until the end of 2026. ESMA will communicate in advance on the planned discontinuation date and the integration of the current register in ESMA’s IT systems.

Update frequency

Please note that ESMA will include the information provided by NCAs regularly in the register but in batches, so information made available to ESMA might not be immediately displayed. Market participants are advised to check the register for possible updates after 19:30 (CET).

Detailed information on the data displayed and its interpretation

Each record displayed in the register provides information at individual DPE and class of financial instrument level for which they have received authorisation by its NCA. In case the authorisation is withdrawn by the NCA, this record will remain in the publication with the information on the date in which this withdrawal was effective.

The DPE status is assigned to the EU investment firms at legal entity level. The DPE register allows to include EU branches of third-country firms that act as DPEs in the Member State of registration – those entities can act as DPEs for counterparties from the same Member State. The respective DPEs can be identified using the fields “ae_thirdCountryFlag” and “ae_thirdCountry”.

The detailed information and formats by each field are displayed in the table below.

Description of the fields in the register

| Field | Description | Format |

|---|---|---|

|

ae_homeMemberState |

Country of the NCA of the investment firm |

ISO 3166 country codes - Alpha 2 |

|

ae_competentAuthority |

NCA of the investment firm |

Name of the NCA |

|

ae_lei |

LEI of the DPE as reported by the NCA |

LEI |

|

ae_lei_name |

Name of the investment firm authorised as DPE |

Alphanumeric |

|

ae_thirdCountryFlag |

When TRUE, the entity is a branch of a third country firm |

Boolean |

|

ae_thirdCountry |

When ae_ thirdCountryFlag is TRUE (entity is a branch of a third country) the country code of the main company |

ISO 3166 country codes - Alpha 2 |

|

ac_serviceCode |

Code of the class of financial instrument |

BOND - Bonds, IRDV - Interest rate derivatives, SFPS - Structured Finance Products, CRDV - Credit derivatives, ETCS - ETCs, ETNS - ETNs, EMAL - Emission Allowances, SHRS - Shares, ETFS - ETFs, CRFT - Certificates, DPRS - Depositary receipts, OTHR - Other equity-like financial instruments |

|

ac_authorisationNotificationDate |

Date of start of authorisation to operate as a DPE for this investment firm in this particular class of financial instrument. |

Date DD/MM/YYYY |

|

ac_authorisationEndDate |

Date of end of authorisation to operate as a DPE for this investment firm in this particular class of financial instrument. |

Date DD/MM/YYYY |

|

ae_status |

In case the investment firm is still authorized to act as a DPE in this particular class of financial instrument at the date of refresh of the register, it will display “Active”. If the authorisation has been withdrawn: “Inactive”. |

Active |

|

ae_lastUpdate |

Date in which the last information on this investment firm and class of financial instrument was updated by NCAs or ESMA |

Date DD/MM/YYYY |

- CSV FILE (last updated: 17 February 2026)

Consultation package – May 2024

MiFIR Review Consultation Package:

- Review of RTS 2 on transparency for bonds, structured finance products and emission allowances, draft RTS on reasonable commercial basis and review of RTS 23 on supply of reference data

- Amendments to certain technical standards for commodity derivatives

- Consolidated Tape Providers and Data Reporting Service Providers

Consultation package – July 2024

MiFIR Review Consultation Package:

Final Reports

- Final Report on equity transparency

- Final Report on the amendments to certain technical standards for commodity derivatives

- Final Report on the Review of RTS 2 on transparency for bonds, structured finance products and emission allowances and RTS on reasonable commercial basis

- Final Report on the single volume cap, Systematic Internalisers and circuit breakers

- Final Report on the Technical Standards specifying the criteria for establishing and assessing the effectiveness of investment firms’ order execution policies

- Final Report on transparency for derivatives, package orders and input/output data for the derivatives consolidated tape