Credit Rating Agencies

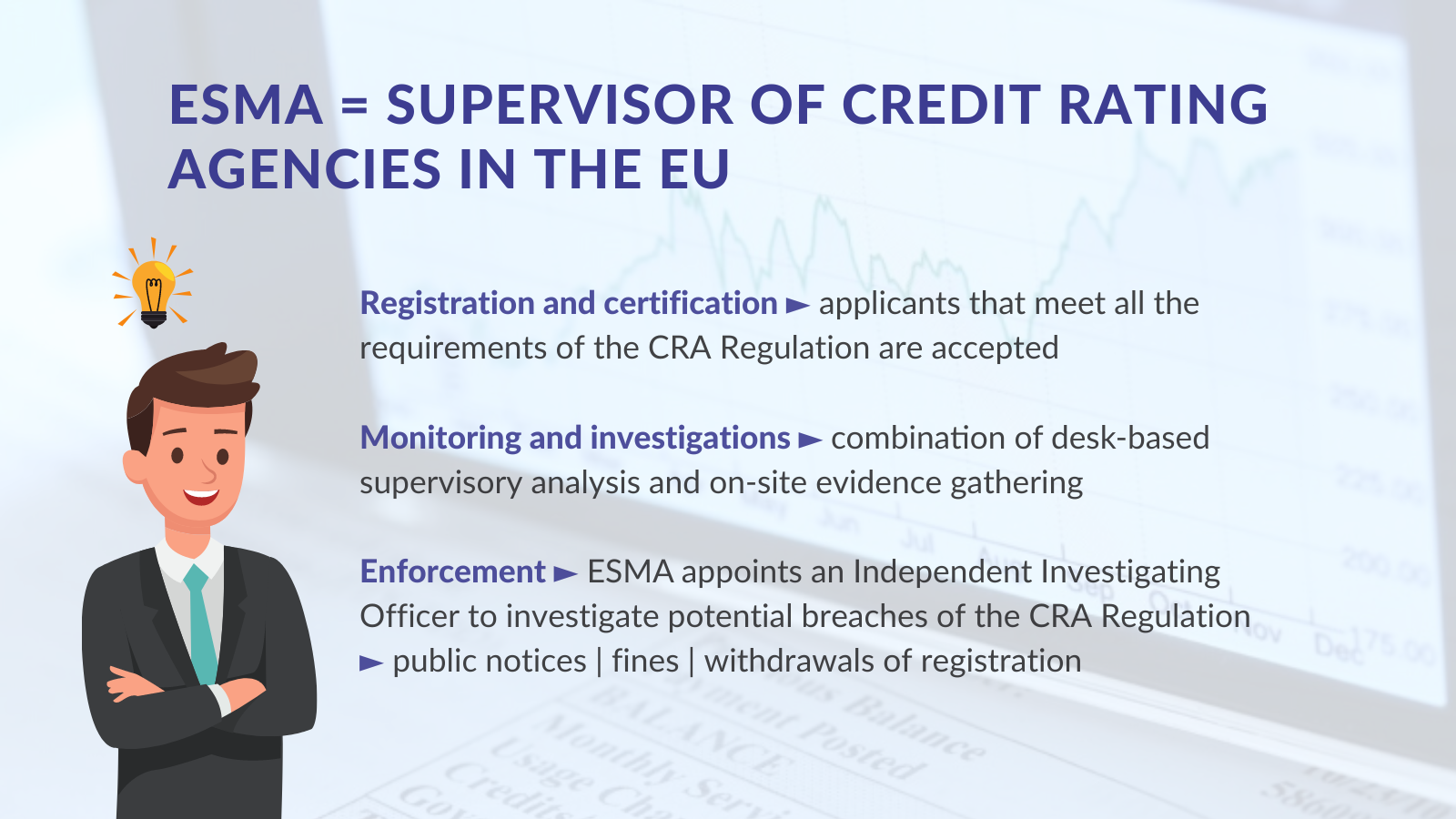

ESMA is the single direct supervisor of Credit Rating Agencies (CRAs) within the EU.

What is the CRA regulation and what does it cover?

The CRA Regulation introduced a common approach to the Regulation and Supervision of CRAs within the European Union. This approach was designed to enhance the integrity, responsibility, good governance and independence of credit rating activities to ensure quality ratings and high levels of investor protection.

The CRA Regulation was amended in 2011 and in 2013.

There are also a number of implementing and delegated acts adopted by the European Commission and Technical Standards developed by ESMA within its scope of action, including Technical Standards for implementing the CRA Regulation.

Registration

Registration and certification are core activities within ESMA’s supervisory responsibilities. For ESMA it is vitally important that the gateway to registered status is guarded diligently and applicants are granted registration only if they demonstrate their ability to meet all the regulatory requirements.

The registration process explained

The registration procedure is defined by Articles 14 to 18 of the CRA Regulation. The process is composed of two stages.

In the completeness phase, the applicant is requested to submit a substantial amount of information on, inter alia, its business plans, resourcing arrangements, governance structures, policies and procedures for ensuring compliance with the CRA Regulation, as well as their rating methodologies. Commission Delegated Regulation 449/2012 with regard to regulatory technical standards on information and certification of credit rating agencies sets out the information that applicants for registration should submit to ESMA.

The completeness phase is then followed by the compliance phase, when ESMA carries out a detailed analysis of whether the applicant’s proposal fully meets the requirements of the CRA Regulation.

The specific timelines for both the completeness and the compliance phases are defined in Articles 15 to 18 the CRA Regulation. Commission Delegated Regulation 447/2012 laying down technical standards for the assessment of compliance of credit rating methodologies is used to assess applicants’ compliance with Article 8(3) of the CRA Regulation.

Please note that ESMA may decide to reopen the completeness phase described in Article 15(4) of Regulation (EC) No 1060/2009 on the basis of the applicant’s submission of new information during the compliance phase referred to in Article 16 of that Regulation, provided that ESMA considers it appropriate and receives the written and unambiguous consent of the applicant.

At the end of the compliance assessment, the decision on whether the applicant is given registered status is made by ESMA’s Board of Supervisors, which consists of senior representatives of the National Competent Authorities (NCAs) from each EU Member State.

A fee will be payable at outset of the registration process. The calculation of fees, as defined by Commission Delegated Regulation EU/272/2012 (the “Fees Regulation”) is based on a several factors such as numbers of employees, whether the applicant has or plans to have branches in another Member State or third country, or whether it intends to issue ratings on structured finance instruments.

If you would like to receive further information on the registration process please contact the Supervision Department at CRA-registration@esma.europa.eu

Perimeter strategy

Any firm that is established in the EU and that carries out credit rating activities in the EU without being registered or certified with ESMA is operating in breach of Articles 2(1) and 14(1) of the CRA Regulation. ESMA systematically takes action, including supervisory measures and fines, against firms that conduct credit rating activities without registration or, where appropriate, certification in the EU.

To ensure compliance with the CRA Regulation, any firm intending to issue credit ratings in the EU must apply for registration or, where applicable, certification with ESMA.

Perimeter assessment explained

Under its perimeter strategy, ESMA uses a variety of sources to identify firms potentially providing credit rating activities without registration or certification, such as internal and external referrals, and desk-based reviews of the publicly available information.

Credit Ratings

A credit rating is an opinion on creditworthiness expressed using a ranking system of rating categories. Further, a credit rating:

- Is issued on a professional basis.

- Is linked to a specific financial instrument or obligation, or issuer of such an instrument or obligation.

- Require analytical input from rating analysts.

- Should be publicly disclosed or distributed by subscription.

Unless explicitly excluded, any activity involving the issuance and distribution of credit ratings, regardless of their intended use, falls within the scope of the CRA Regulation. When assessing a firm’s activities, ESMA considers the exclusions listed in Article 2(2) of the CRA Regulation.

The following exclusions define activities and products that are outside the scope of the CRA Regulation and that are not supervised by ESMA:

- Private credit ratings: Credit ratings produced pursuant to an individual order, provided exclusively to the person placing the order, and not intended for public disclosure or distribution by subscription.

- Credit scores, scoring systems or similar assessments related to obligations arising from consumer, commercial or industrial relationships.

- Credit ratings produced by export credit agencies, subject to specific conditions.

- Credit ratings produced by central banks, subject to specific conditions.

Private Credit Ratings

The ESMA Guidelines on the scope of the CRA Regulation (revised in 2022 and applicable since 1 May 2024) clarify important aspects of private credit ratings. They also help ESMA identify the activities of private credit rating providers that fall outside the scope of the CRA Regulation.

Further, private credit ratings are:

- Produced pursuant to an individual order: The private credit rating should only be produced following an explicit order, formalised through a bilateral written agreement.

- Provided exclusively to the person who placed the order: The agreement should contain a provision on the exclusive issuance of the private credit rating only to the person who placed the order. Therefore, the private credit rating shall be provided only to the person who placed the order.

- Not intended for public disclosure or distribution by subscription:

A rating which is provided to different persons belonging to a list of subscribers does not fall within the definition of “private credit rating”.

However, the recipient of a private credit rating is allowed to share the rating with “a limited number of third parties” on a confidential basis. The revised Guidelines clarify that these third parties may be either natural or legal persons and that the cumulated number of persons cannot exceed 150.

This sharing must be strictly confidential, and the rating provider should implement appropriate controls to monitor the adherence to the 150-person limit, ensuring the private credit rating does not become public

Credit Scores

A credit score is a measure of creditworthiness and not an opinion on creditworthiness. A credit score derives solely from the assessment of data based only on a pre-established statistical system or model, without substantial rating-specific analytical input from a rating analyst.

Regardless of how firms choose to market their credit scores (e.g. using terms like “rating” or similar), this product does not fall under the scope of the CRA Regulation and is, consequently, not supervised by ESMA.

ESMA recommends firms (including credit rating agencies) distributing credit scores in the EU to clearly and prominently disclose that these products are not credit ratings issued in accordance with the CRA Regulation and are, consequently, not supervised by ESMA.

Further information

For further information, please refer to the Guidelines on the scope of the CRA Regulation and to the Report accompanying these Guidelines.

If you have any information which may assist ESMA’s perimeter strategy or if you are a firm seeking clarification about whether your activities fall within the definition of credit rating activities under Articles 2, 3(1) and 14(1) of the CRA Regulation please contact the Conduct Supervision and Convergence Department at CRA-info@esma.europa.eu.

Ongoing supervision and investigations

ESMA’s supervision for CRAs is risk-based, outcome-based and data-driven. Following the registration, ESMA supervises the registered entities through a combination of desk-based supervisory activities and investigation. As part of its desk-based supervisory activities, ESMA:

- Monitors and analyses ratings data submitted to ESMA by CRAs.

- Analyses the periodic information that CRAs submit to ESMA.

- Analyses complaints received by market participants.

- Reviews notifications of material changes to the initial conditions from registration.

As part of its supervisory activity, ESMA also conducts investigations that may or may not involve on-site visits.

ESMA has the power to take appropriate enforcement action where it discovers a breach of the CRA Regulation. These actions can range from the imposition of fines to the withdrawal of registration.

Complaints

If you wish to submit a complaint about a credit rating agency, please fill in this form and email it to CRA-info@esma.europa.eu. In the subject of your email, please state "Complaint about credit rating agency".

If you are a whistleblower, please see the Whistleblower section.

Non-EU Credit Rating Agencies

If a non-EU CRA wants its ratings to be used for regulatory purposes in the EU (i.e. by EU financial institutions) the CRA Regulation provides for two alternatives, certification or endorsement.

Equivalence / certification

The equivalence regime is made available for CRAs from non-EU countries with no presence or affiliation in the EU, provided they are not systemically important for the financial stability or integrity of the financial markets of one or more Member States, and in order to allow the use in the Union of credit ratings related to entities established, or financial instruments issued in non-EU countries.

This certification process will take into consideration the size of the CRA, in view of the nature, complexity and range of issuance of its credit ratings on which the CRA may be exempted from a physical presence in the EU. This procedure requires a previous decision by the European Commission on the equivalence of the non-EU country regulatory and supervisory regime on CRAs and the establishment of a cooperation arrangement between ESMA and the relevant non-EU country Authority.

Endorsement

The endorsement regime is made available for CRAs that are affiliated or work closely with EU-registered CRAs. When an EU-registered CRA (the endorsing CRA) endorses a credit rating issued by another CRA of the same group established outside the Union, the rating can be used for regulatory purposes in the EU.

An EU CRA should not begin endorsing credit ratings before ESMA has completed two separate assessments, namely: an assessment of the conditions relating to the legal and supervisory framework of the third country and an assessment of certain conditions relating to the CRAs intending to endorse credit ratings.

Furthermore, an endorsement implies that the endorsing CRA assumes full and unconditional responsibility for ensuring that all the conditions for endorsement are met on an ongoing basis.

Should you have any comments or questions regarding ESMA’s work in this area please feel free to contact us via: cra-info@esma.europa.eu

| Equivalence/Certification | Endorsement | |

|---|---|---|

| Type of credit ratings | Credit ratings issued on non-EU issuers or instruments and from third countries | Credit ratings on EU and non-EU issuers or instruments. |

| Credit ratings issued | By a CRA established & supervised in a third country, which may be exempted from a physical presence in the EU. | By a CRA based outside the EU but belonging to the same group of a CRA registered with ESMA. |

| Can be used for regulatory purposes in the EU if (non-exhaustive) … |

|

|

| … for credit ratings issued in |

(Countries for which the European Commission has adopted a decision that the third country regime is equivalent to the EU Regulation) |

(Countries for which ESMA has assessed that the third country legal and supervisory framework meets the conditions for endorsement) |

Memoranda of Understanding (MoU)

In the context of international cooperation for the supervision of CRAs, ESMA has signed the following MoUs:

- Argentina

- Australia

- Brazil

- Canada

- Dubai

- Hong Kong

- Mexico

- Singapore

- South Africa

- Switzerland

- United Arab Emirates

- United Kingdom

- US Securities and Exchange Commission

Credit Rating Agencies policy work

ESMA carries out policy work in the area of Credit Rating Agencies in its role as the single supervisor of Credit Rating Agencies within the European Union.

Overview

ESMA’s policy work in this area can derive from a wide number of areas, including the requirements of relevant pieces of EU legislation, requests from the European Commission or in response to the needs of Market Participants. The most common forms which this work can take are:

- Guidelines

- Questions and Answers

- Technical Advice

- Technical Standards

Regardless of the form of any work undertaken, ESMA’s policy work in this area is carried out in cooperation and consultation with the members of the CRA Technical Committee, which has representatives from the EU national competent authorities.

Further information on ESMA’s Guidelines on the Application of the CRA Regulation:

- Guidelines on the Scope of the CRA Regulation | Translations | Final Report.

- Guidelines on the Validation and review of Credit Rating Agencies’ methodologies | Translations | Final Report

- Guidelines on the application of the endorsement regime under Article 4(3) of the Credit Rating Agencies Regulation | Translations | Final Report

- Guidelines on Disclosure Requirements Applicable to Credit Ratings | Translations | Final Report

- Guidelines on Internal Controls for CRAs | Translations | Final Report

- Guidelines on Disclosure Requirements for Initial Reviews and Preliminary Ratings | Translations | Final Report

- Questions and Answers on the implementation of the CRA Regulation

Further information on ESMA’s Guidelines on Periodic Information: