ESMA performs an analysis of the cross-border investment activity of firms

The European Securities and Markets Authority (ESMA), the EU’s financial markets regulator and supervisor, and national competent authorities (NCAs) completed an analysis of the cross-border provision of investment services during 2022.

The increase in the cross-border provision of financial services has benefits for consumers and firms, as it fosters competition, expands the offer available to consumers and the market for firms. However, it also requires that NCAs intensify their efforts and focus more on the supervision of cross-border activities and cooperation to tackle the issues arising from these activities.

The data collected and analysed across 29 jurisdictions allows ESMA and NCAs to shed light on various aspects of the market for retail investors that receive investment services by credit institutions and investment firms established in other Member States.

Key findings of the data collection[1] include:

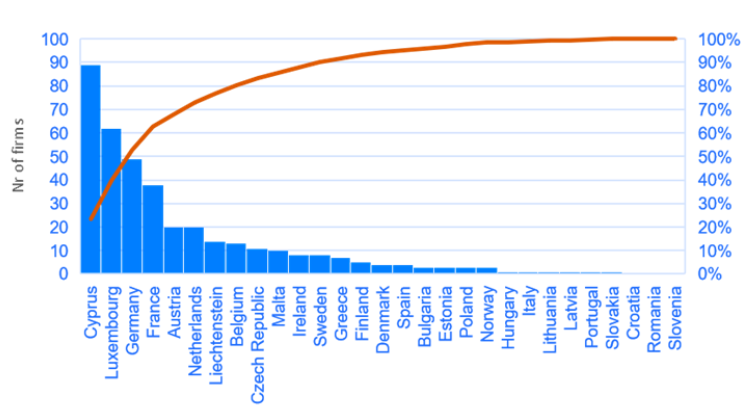

- A total of around 380 firms[2] provided services to retail clients on a cross-border basis in 2022. The majority of them (59%) are investment firms, while 41% are credit institutions.

- Approximately 7.6 million clients in the EU/EEA received investment services from firms located in other EU/EEA Member States in 2022.

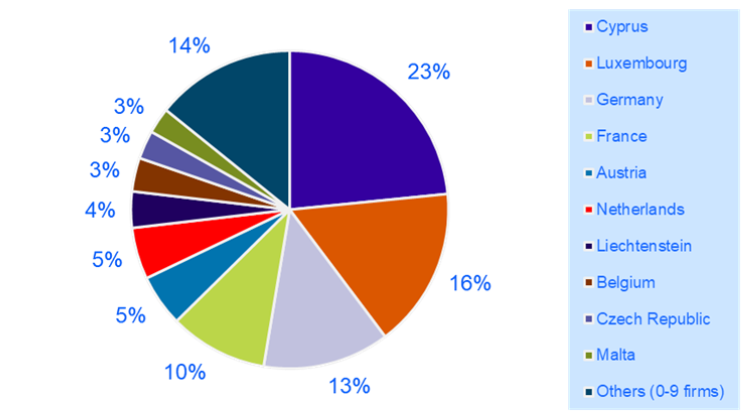

- In terms of number of firms, Cyprus is the primary location for firms providing cross-border investment services in the EU/EEA, accounting for 23% of the total firms passporting investment services. Luxembourg and Germany follow with 16% and 13% of all firms, respectively.

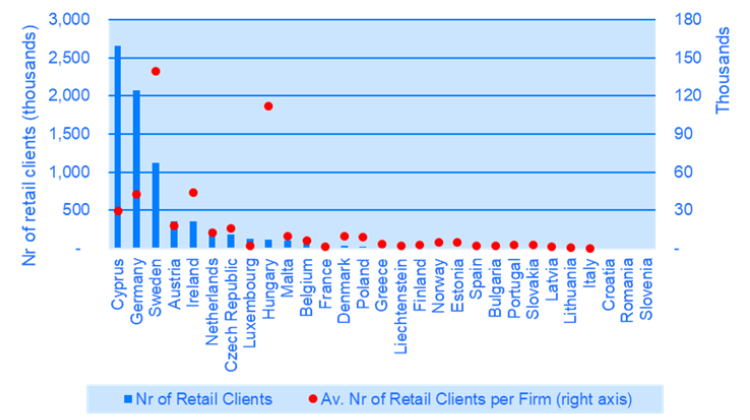

- Looking at the number of EU/EEA retail clients receiving cross-border investment services, more than 75% are served by firms based in three jurisdictions: Cyprus, Germany, and Sweden. Cyprus-based firms reported activity to around 2.5 million cross-border retail clients, German-based firms to around 2 million retail clients and Sweden-based firms to more than 1 million retail clients. All other firms in the scope of the exercise reported a total of around 1.8 million cross-border retail clients, accounting for about a quarter of the total number of retail clients.

- The average number of cross-border retail clients per firm varied from 189 (for the only firm in Italy) to about 140,000 retail clients (for the 8 firms based in Sweden). Overall, the average number of retail clients per firm was about 19,000.

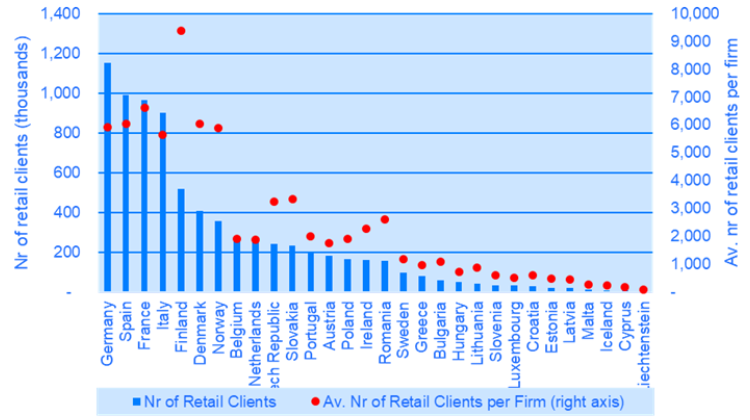

- As host Member States, Germany, Spain, France and Italy are the most significant destinations (in terms of number of retail clients) for investment firms providing services cross-border in other Member States.

- Approximately 5,700 complaints were recorded by firms relating to the provision of cross-border investment services to retail clients in 2022. The number of complaints received is proportional to the number of clients served by firms providing cross-border investment services.

- The data analysis highlighted that clients of cross-border investment services primarily lodged complaints[3] about “terms of contract/fees/charges” and about “issues pertaining to general admin/customer services”. Fewer complaints were reported on the topics of “investment products not appropriate/suitable for the client” and “market event related”.

Next steps

ESMA aims to continue performing the data collection exercise on annual basis and endeavours to publish a Report on the findings at the next iteration of the exercise in 2024.

|

Distribution of firms across EU/EEA Member States

|

Shares of firms by home Member State

|

|

Number of clients by home Member State

|

Number of clients by host Member State

|

[1] Some country specific figures may have to be interpreted with a note of caution as the firm-level reporting did not always follow the ESMA template.

[2] Firms that provided investment services to less than 50 retail clients in any other Member State where not included in the scope of the data collection exercise. This approach has allowed for clear proportionality in conducting the exercise, with no burden for firms below the materiality threshold.

[3] Firms recorded the most frequent complaint topics among the following eight (8) categories:

- Quality or lack of information provided to the client

- Investment product not appropriate/suitable for the client

- Terms of contract/fees/charges

- General admin/customer services (including custody/safekeeping services)

- Issue in relation to withdrawal of investor's funds from an account / issue connected to exit from the investment and redemption of funds

- Market event related

- IT issues

- Other

Further information:

Solveig Kleiveland

Communications Team Leader

@ Email: press@esma.europa.eu