ESMA Newsletter - Nº11

Welcome to the eleventh edition of ESMA's newsletter. In this issue, we take a look at our full list of ESMA staff speaking appearances and we catch up on publications from December and January. Also, new vacancies have been opened with a deadline for applications of 31 January .The Board of Supervisors will meet next week on 29 January at our premises near Gare de Lyon in Paris, so stay with us for more updates.

ESMA Board of Supervisors meeting on 29 January 2020.

- ESMA's Board of Supervisors is going to meet next week on 29 January at our premises near Gare de Lyon.

Speaking appearances by ESMA staff this month

- The full list of ESMA's planned speaking appearances for January can be found here

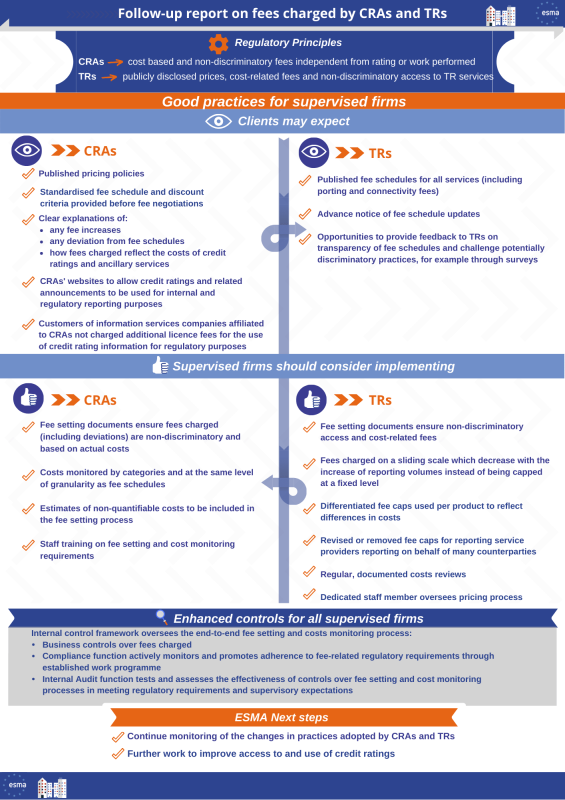

Follow-up to the Thematic Report on fees charged by Credit Rating Agencies and Trade Repositories : check out the factsheet.

Vacancy Notices

| Policy & Convergence Officer - Temporary Agents (AD5) | 31/01/2020 |

| Supervision & Convergence Officer - Temporary Agents (AD5) | 31/01/2020 |

| Economics, Risk and Data Analysis Officer - Temporary Agents (AD5) | 31/01/2020 |

| Administrative Assistant - Contract Agents (FGIII) | 31/01/2020 |

| Traineeship notice – Transversal profile (F/M) | 31/12/2020 |

| Traineeship notice – Legal profile (F/M) | 31/12/2020 |

| Traineeship notice - Financial Markets Profile (F/M) | 31/12/2020 |

All open vacancies can be found on ESMA's recruitment portal

Missed any ESMA publications? Check out the full list of news items from our press office.

- Publication period: 20 December - 24 January 2020

|

21 January ESMA publishes responses to joint consultation paper on PRIIPs KID |

ESMA has published the responses received to the Joint Consultation Paper concerning amendments to the PRIIPs KID. |

|

17 January ESMA consults on the use of No Data options in securitisation reporting |

The European Securities and Markets Authority (ESMA), the EU’s securities markets regulator, has published a Consultation Paper on Guidelines on securitisation repository data completeness and consistency thresholds. The consultation’s objective is to help market participants and securitisation repositories to understand ESMA’s expected maximum use of No Data options contained within a securitisation data submission. |

|

13 January ESMA publishes responses to its consultation on MiFID II review report on position limits |

ESMA has published the responses received to its consultation on MiFID II review report on position limits and position management. |

|

10 January ESMA report values EU Alternative Investment Funds at €5.8 trillion |

The European Securities and Markets Authority (ESMA) published its second statistical report on European Union (EU) Alternative Investment Funds (AIF). The study found that the EU AIF sector in 2018, as measured by Net Asset Value (NAV), amounted to €5.8tn or nearly 40% of the total EU fund industry. The report is based on data from 30,357 AIFs, or almost 100% of the market. |

|

09 January |

The European Securities and Markets Authority (ESMA) has updated its public register with the latest set of double volume cap (DVC) data under the Markets in Financial Instruments Directive (MiFID II). |

|

09 January |

The European Securities and Markets Authority (ESMA), the EU’s securities markets regulator, has published its Strategic Orientation for 2020-22. The Strategic Orientation sets out ESMA’s future focus and objectives and reflects its expanded responsibilities and powers following the ESAs Review, and EMIR 2.2, which increases its focus on supervisory convergence, strengthens its role in building the Capital Markets Union (CMU) and gives it with more direct supervision responsibilities. |

|

07 January ESMA clarifies rules for CCPs’ membership criteria and due diligence |

The European Securities and Markets Authority (ESMA) has issued a report on a survey it conducted into membership arrangements and due diligence by central counterparties (CCPs) towards their clearing members. |

|

07 January ESMA assesses EU financial market impact of circuit breakers |

The European Securities and Markets Regulator (ESMA), the EU’s securities markets regulator, publishes a study on the market impacts of circuit breakers. |

|

06 January |

The European Securities and Markets Authority (ESMA) has published its final report, its Guidelines on reporting under the Securities Financing Transactions Regulation (SFTR), amended SFTR validation rulesand a statementon Legal Entity Identifiers (LEI). |

|

23 December ESMA extends recognition decisions for 3 UK CCPs in the event of a no-deal Brexit |

The European Securities and Markets Authority (ESMA) has announcedthat it has extended the recognition decisions for the three central counterparties (CCPs) established in the United Kingdom (UK) to reflect the extension of the expiry date of the Implementing Decision (EU) 2018/2031 of the European Commission on the equivalence of the UK CCP legal framework. |

|

20 December ESMA: EU issuers need to improve their disclosure of alternative performance measures |

The European Securities and Markets Authority (ESMA) has published a report on European Union (EU) issuers’ use of Alternative Performance Measures (APMs) and their compliance with ESMA’s APM Guidelines. |

|

20 December |

The European Securities and Markets Authorty (ESMA), the EU's securities markets regulator, has published updated ISO 20022 XML Schemas to be used for reporting under the Securities Financing Transactions Regulation (SFTR). |

|

20 December ESMA provides updated XML schema and reporting instructions for securitisation reporting |

The European Securities and Markets Authority (ESMA), the EU’s securities markets’ regulator, has published updated reporting instructions and XML schema for the templates set out in the technical standards on disclosure requirements. |

|

20 December ESMA updates ESEF XBRL taxonomy files to facilitate implementation of the ESEF regulation |

The European Securities and Markets Authority (ESMA), the EU securities markets regulator, has updated the ESEF XBRL taxonomy files to reflect the 2019 update of the ESEF Regulation. |

|

20 December ESMA: further action needed on fees for credit ratings and Trade Repository services |

The European Securities and Markets Authority (ESMA) has published a Follow Up to the Thematic Report on fees charged by Credit Rating Agencies (CRAs) and Trade Repositories (TRs). |