Original question

Original language

While it is expected that IFRS 18 impacts primarily the financial statements of issuers, this Q&A focuses solely on the interaction between the IFRS 18 requirements and the ESMA Guidelines on Alternative Performance Measures (APM Guidelines). In particular, it provides insights into the main differences in concepts, scope and principles between ‘Management-defined Performance Measures (MPMs)’ under IFRS 18 and alternative performance measures (APMs) as defined in the APM Guidelines. This Q&A also provides guidance on how issuers may ensure compliance with the APM Guidelines in light of the new requirements introduced by IFRS 18 (effective on 1 January 2027).

ESMA notes that the APM Guidelines are still fit for purpose and will continue to fully apply after IFRS 18 enters into force. In the following sections, ESMA highlights the most relevant similarities and differences that issuers should take into account when complying with the APM Guidelines, considering the requirements arising from IFRS 18.

1.1. Measure location (where the measures are disclosed):

ESMA highlights that the application scope of the APM Guidelines and IFRS 18 requirements is different:

-

The APM Guidelines apply to regulated information[1] (e.g. ad-hoc disclosures published under Article 17 of MAR[2] and management reports published pursuant to the Transparency Directive) and prospectuses drawn up in accordance with the Prospectus Regulation[3].

-

IFRS 18 requires issuers to disclose, inside the financial statements, subtotals of income and expenses that are, among other criteria[4], used in public communications.

The concept of public communications included in IFRS 18 is generally broader than the scope of application of the APM Guidelines, as it may also include measures contained in documents that are not covered by MAR, TD or PR[5] (e.g. websites of the issuer and other communication documents) [6]. Hence, when assessing the application of IFRS 18 and its interaction with the APM Guidelines, issuers may need to consider if all measures used in the different communication documents meet the definition of an MPM.

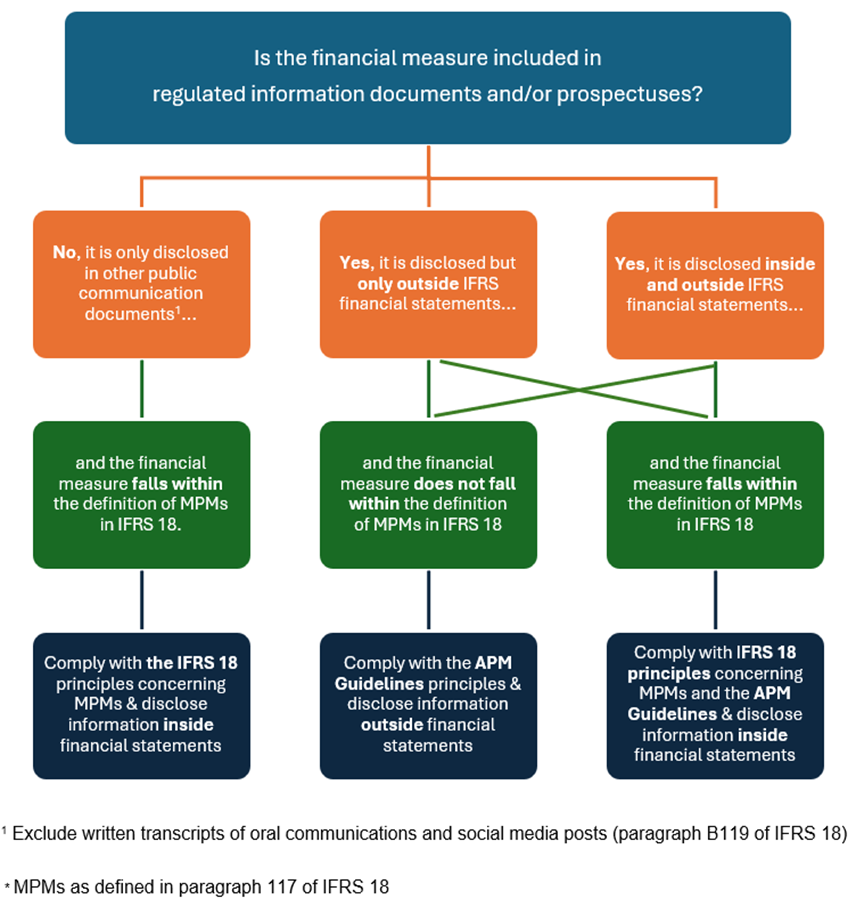

The following flow-chart illustrates the different compliance scenarios that apply based on the location[7] of the measure:

1.2. Definition of APM vs MPM

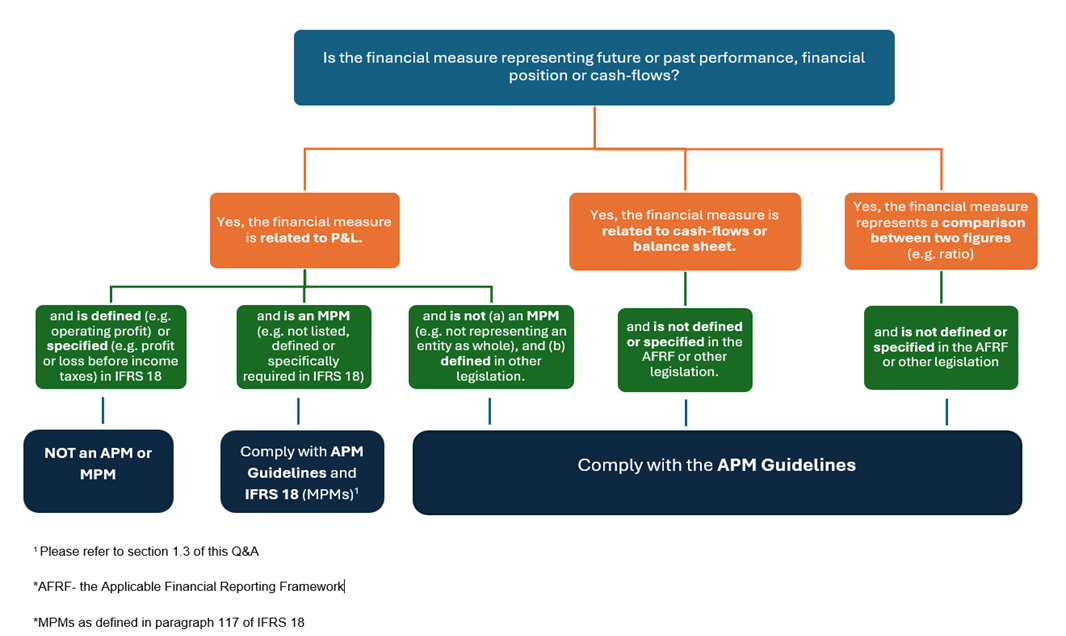

Both IFRS 18 as well as the APM Guidelines include broad definitions of APMs and MPMs. These definitions are intended to capture a broad range of measures that are (i) in the case of IFRS 18, not specifically required to be presented or defined by IFRS Accounting Standards; and (ii) in the case of the APM Guidelines, not defined or specified by the applicable financial reporting framework or by any other legislation. ESMA highlights, however, the following:

|

APMs under the APM Guidelines |

MPMs under IFRS 18 |

|

The APM Guidelines apply to measures calculated based on figures determined by any financial reporting framework, including national GAAPs and IFRS. They cover performance, position, and cash-flow measures (e.g. ratios, net debt, segment data) that: - are not defined or specified in the applicable financial framework or other legislation, - are presented outside the financial statements, and - are disclosed within regulated information documents and/or prospectuses. |

IFRS 18 defines MPMs as a subtotal of income and expenses that is used to communicate to investors management’s view of an aspect of the financial performance of the company as whole and it is not listed in IFRS 18 or specifically required by IFRSs. These may include measures that are presented on the face of the statement of the profit or loss.

|

Based on the above types of measures covered, generally MPMs represent a subset of APMs as defined by the APM Guidelines. When assessing which principles and requirements are applicable, issuers should verify where the performance measure is disclosed and whether it meets the definitions of MPMs and/or APMs. Depending on this assessment, issuers may need to assess where the applicable disclosures should be included. Notably:

-

if measures are MPMs but are not disclosed within regulated information documents, all the applicable disclosures should be included inside financial statements as required by IFRS 18 (in a single note), or

-

if measures are MPMs, fall within the scope of the definition of an APM and are included in regulated information documents and/or prospectus, the principles of the APM Guidelines and IFRS 18 apply. Please refer to section 1.3 of this Q&A and to Q&A #1868 on the APM Guidelines, regarding the location of the applicable disclosures and other principles, or

-

if measures fall within the definition of an APM pursuant to the APM Guidelines, are disclosed in documents under the scope of the APM Guidelines and are not MPMs - the applicable disclosures should be provided outside financial statements.

Finally, ESMA notes that IFRS 18 does not define ‘earnings before interest, tax, depreciation and amortisation’ (EBITDA). However, the Standard specifically lists ‘operating profit or loss before depreciation, amortisation and impairments’ within the scope of IAS 36’ (OPDAI) which may provide similar information to many of the EBITDA measures currently used. Therefore, if EBITDA does not accurately describe the corresponding measure (e.g., an issuer, applying classification requirements of IFRS 18 correctly, has no income and expenses in the investing category and no interest income in the operating category)[8], this measure is both MPM and APM and issuers should comply with the relevant principles in IFRS 18 and the APM Guidelines.

1.2.1 Measures specified (listed) in IFRS 18

Subtotals of income and expenses that are specifically required to be presented or disclosed by IFRS Accounting Standards as well as those listed in paragraph 118 or B123 of IFRS 18 do not meet the definition of an MPM. Generally, these measures also do not fall within the scope of the APM Guidelines as they are defined or specified in the applicable financial reporting framework (i.e., IFRS Accounting Standards). Totals and subtotals specified by IFRS 18 (i.e. not meeting the definition of MPMs and APMs) include: operating profit, profit before financing and income taxes, operating profit or loss and all income and expenses classified in the investing category, profit or loss before income taxes, profit or loss from continuing operations.

Issuers should, however, be cautious as any deviation from the application of IFRS 18 requirements regarding the calculation of such measures (e.g. excluding or including any expenses or income items that are not in line with paragraphs 118 or B123 of IFRS 18) may lead to the application of the APM Guidelines (if these measures are presented outside financial statements and within regulated information documents or prospectuses).

The following flow-chart illustrates different scenarios where the financial measure may be in the scope (definitions) of the APM Guidelines only, IFRS 18 only or both:

1.3. Application of the APM Guidelines to MPMs (What to disclose)

ESMA acknowledges that the principles included in IFRS 18 requiring additional disclosure of information in relation to MPMs are generally consistent with the principles included in the APM Guidelines requiring additional disclosure of information in the context of APMs. Therefore, it is not expected that the introduction of IFRS 18 will increase the reporting burden related to the measures that are currently in scope of the APM Guidelines. However, ESMA highlights key differences to consider:

-

Timing: IFRS 18 requires issuers to disclose information such as reconciliations, explanations, definitions concerning MPMs in IFRS financial statements when the financial statements are published. Conversely, the APM Guidelines require similar disclosures when these measures are disclosed to the public, i.e., the disclosures required by the APM Guidelines should generally be provided at the same time and in the same document where the APM is disclosed (regulated information documents and/or prospectuses). Please refer to d) below regarding compliance by reference principle.

-

Reconciliations: the principles included in the APM Guidelines do not require the disclosure of the income tax effect and the effect on non-controlling interests for each item included in the reconciliation between APMs and figures included inside financial statements. IFRS 18 requires such disclosure when a given measure meets the definition of an MPM. Furthermore, IFRS 18 requires a reconciliation between the MPM and the most directly comparable subtotal listed in paragraph 118 or total or subtotal specifically required to be presented or disclosed by IFRS. While this requirement is not fully aligned with the principle included in the APM Guidelines in paragraph 26, if issuers apply the reconciliation requirements in IFRS 18, they will also comply with the reconciliation requirements in the APM Guidelines.

-

Prominence: According to the APM Guidelines, APMs should not be displayed with more prominence, emphasis or authority than measures directly stemming from financial statements. Considering IFRS 18’s entry into force and the new concept of MPMs (which requires certain information to be included in the notes to IFRS Financial Statements), ESMA highlights that issuers should not display any APMs (including measures that meet the definition of an MPM) with more prominence, emphasis or authority than measures defined or specifically required by IFRS. I.e., if issuers disclose APMs (including MPMs) in regulated information documents and prospectuses, issuers should also include in these documents, measures defined by IFRS with, at least, equal prominence.

-

Compliance by reference: while IFRS 18 requires issuers to disclose all information on MPMs in one note to the financial statements, the APM Guidelines do not set specific requirements as to where and how such disclosures should be provided, allowing issuers to comply by reference[9] (i.e., issuers are not required to include all the information prescribed in the APM Guidelines in the same document where an APM is disclosed provided that the issuer includes a direct reference to other documents previously published which contain this information and are readily and easily accessible to users).

Where APMs are simultaneously MPMs, issuers may use the compliance by reference principle to direct users to the information included in a specific note to the published IFRS financial statements (where these disclosures - e.g. reconciliations, explanations - are included). This procedure may avoid repetition of (some of) the information (i.e. issuers may not need to disclose twice the same information e.g. in the financial statements and in the regulated information documents). However, ESMA notes that there are limits for the compliance by reference, in this respect, please refer to Q&A #1876 on the APM Guidelines.

Finally, ESMA notes that prospectuses are covered by a separate regime for incorporation by reference as provided under Article 19 of Regulation (EU) 2017/1129, which includes a specific list of the types of documents (which includes financial statements) from which information can be incorporated by reference into a prospectus.

To the extent that the relevant disclosures (e.g., reconciliations and explanations) are included in a document from which information can be incorporated by reference into a prospectus, ESMA considers that this information should be incorporated by reference into the issuer's prospectus in accordance with Article 19.

[1] As defined in Article 2 (k) of Directive 2004/109/EC of the European Parliament and of the Council of 15 December 2004 on the harmonisation of transparency requirements in relation to information about issuers whose securities are admitted to trading on a regulated market (Transparency Directive or TD).

[2] Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (Market Abuse Regulation or MAR).

[3] Regulation (EU) 2017/1129 of the European Parliament and of the Council of 14 June 2017on the prospectus to be published when securities are offered to the public or admitted to trading on a regulated market, and repealing Directive 2003/71/EC (Prospectus Regulation)

[4] See paragraph 117 of IFRS 18 for further details.

[5] See paragraphs B119 – B122 of IFRS 18 for further details.

[6] Please note that measures disclosed in social media posts are outside the scope of IFRS 18.

[7] This flow-chart does not address the differences in the definitions of APM & MPM (please refer section 1.2).

[8] See paragraphs BC363-365 of Basis for Conclusions on IFRS 18.

[9] Where compliance by reference is permitted or possible (Paragraph 45 of the APM Guidelines).