Original question

Original language

[ESMA 70-872942901-35 MiFIR transparency Q&A, Q&A 7.13]

Yes. Systematic internalisers should comply with the requirements that correspond to the current liquidity status of an instrument.

Therefore, if the liquidity status of a financial instrument changes (regular transparency calculations or amendment of the information available on the ESMA website), systematic internalisers in that instrument should adapt the quoting arrangements accordingly. Considering that quoting requirements are stricter for liquid than illiquid instruments, a systematic internaliser can however choose to voluntarily comply at all times with the stricter requirements applicable to liquid instruments without monitoring the liquidity status of the instruments for which it is an SI.

ESMA acknowledges that the criteria and thresholds for determining whether an investment firms is considered acting as a systematic internaliser differ between liquid and illiquid instruments. Investment firms that passed the systematic internaliser test for a financial instruments which liquidity status has changed (e.g. from illiquid to liquid) are therefore allowed (but not required) to re-assess whether they still qualify as systematic internalisers using the criteria and thresholds corresponding to the new liquidity status. Where an investment firm decides to re-assess its systematic internaliser status for such a financial instrument and, under the new liquidity status of the financial instrument, no longer meets the thresholds and criteria of the test, this investment firm should notify its competent authority accordingly.

In case of bonds, the liquidity determination and data publication for the SI tests are aligned. Investment firms should use the liquidity status that has just been published by ESMA on the first day of the month to perform the SI test, although this new liquidity status will formally be applicable only on the 16th day of the month.

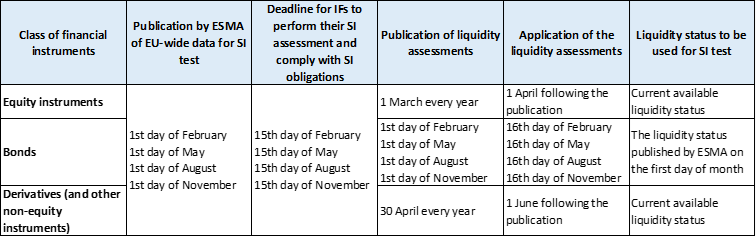

The table below illustrates the timeline for the publication and application of the annual or quarterly liquidity assessments and the deadlines for the SI determination.

English

Yes. Systematic internalisers should comply with the requirements that correspond to the current liquidity status of an instrument.

Therefore, if the liquidity status of a financial instrument changes (regular transparency calculations or amendment of the information available on the ESMA website), systematic internalisers in that instrument should adapt the quoting arrangements accordingly. Considering that quoting requirements are stricter for liquid than illiquid instruments, a systematic internaliser can however choose to voluntarily comply at all times with the stricter requirements applicable to liquid instruments without monitoring the liquidity status of the instruments for which it is an SI.