Original question

Original language

[ESMA 33-128-563 Securitisation Q&A, Q&A 5.1.8.a]

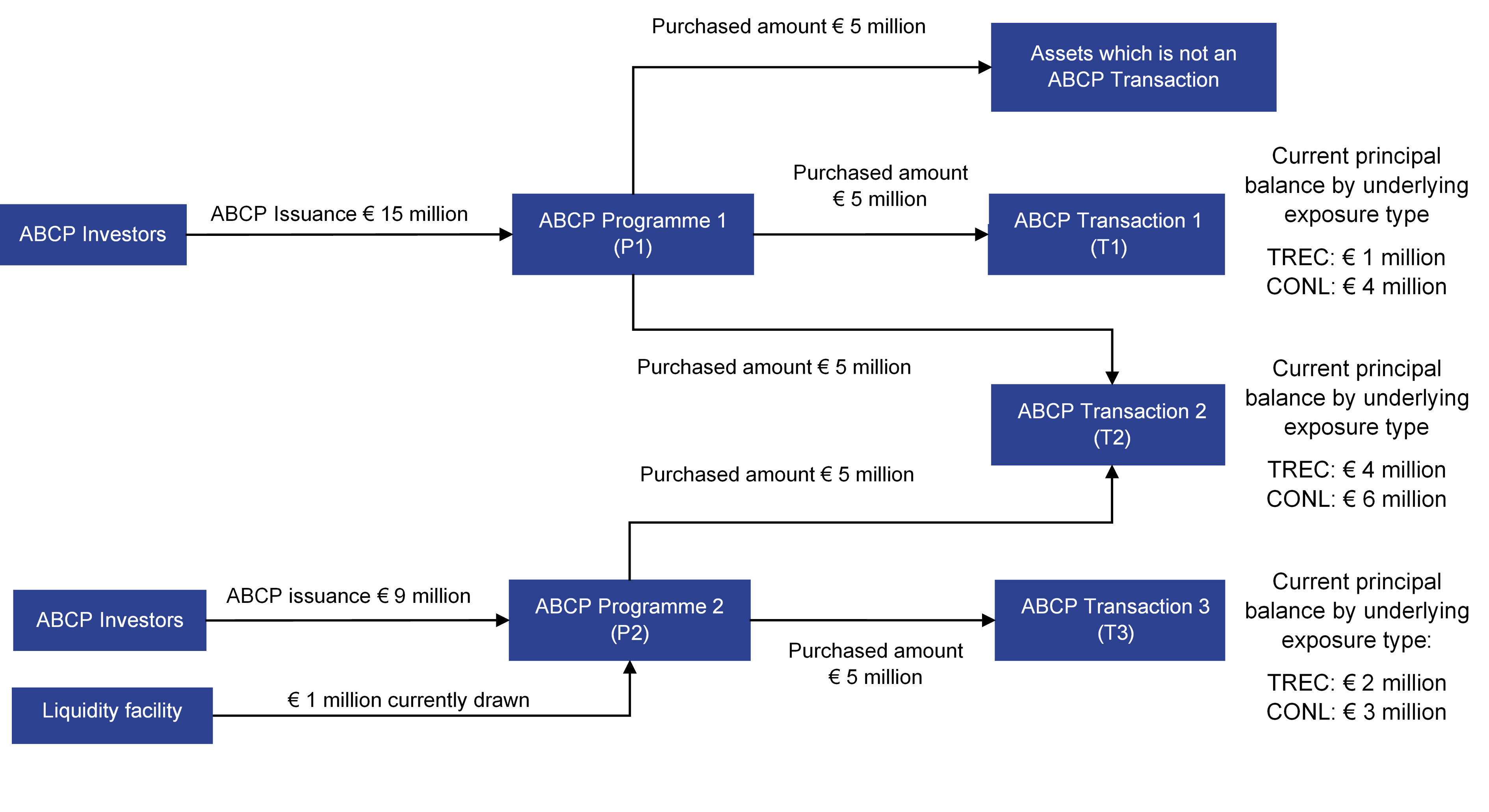

A single consolidated report should be created for each ABCP Programme and all the ABCP Transactions within that Programme. Take the example illustrated in the figure below with two ABCP Programmes (P1 and P2) funding three ABCP transactions T1, T2 and T3. Each Transaction contains two types of underlying exposures Trade Receivables (‘TREC’) and Consumer Loans (‘CONL’).

ABCP Programmes “P1” and “P2” are co-funding transaction “T2”. At the same time “P1” is funding the transaction “T1” on a stand-alone basis and P2 is funding the transaction “T3” on a stand-alone basis. In this example, two reports need to be generated, one for P1 and one for P2. The contents of each report is summarised in the table below. For the purpose of this example, this is assumed to be ‘public’ structure. For more information about the disclosure requirements applicable to public and private securitisation see Q&A 1256.

|

|

Annex / Section to be completed |

|

|

Report for P1 includes |

Annex 13 “Investor Report” including

|

|

|

Annex 15 “Inside Information Or Significant Event Report” including

|

||

|

Annex 11 for Trade Receivables (TREC) in T1 |

||

|

Annex 11 for Consumer loans (CONL) in T1 |

||

|

Annex 11 for Trade Receivables (TREC) in T2 |

||

|

Annex 11 for Consumer loans (CONL) in T2 |

||

|

Report for P2 includes |

Annex 13 “Investor Report” including

|

|

|

Annex 15 “Inside Information Or Significant Event Report” including

|

||

|

Annex 11 for Trade Receivables (TREC) in T2 |

||

|

Annex 11 for Consumer loans (CONL) in T2 |

||

|

Annex 11 for Trade Receivables (TREC) in T3 |

||

|

Annex 11 for Consumer loans (CONL) in T3 |

In each case, the field SEAR3 ‘Number Of Programmes Funding The Transaction’ in Annex 15 should be completed accordingly, in order to identify the other programme identifiers associated with this transaction.