Original question

Original language

[ESMA 34-43-392 UCITS Q&A, section 2, Q&A 8c]

To satisfy the requirements of this element of the Article, investors should be provided with an indication of how actively managed the UCITS is, compared to its reference benchmark index. The KIID should strike a balance between providing the level of detail required to sufficiently disclose a UCITS’ degree of freedom from a benchmark index, and the obligation to do so in clear language understandable to a retail investor.

On this basis, the UCITS management company should at least take into account the following elements when indicating in the KIID the degree of freedom from the benchmark index for actively managed UCITS whose investment approach includes or implies a reference to a benchmark index:

- The description of the underlying investment universe of the UCITS should indicate to what extent the target investments are part of the benchmark index or not.

- The KIID should describe the degree or level of deviation of the UCITS in regards to the benchmark index, thereby considering, where applicable, the quantitative and/or qualitative deviation limitations underlying the investment approach (e.g. risk limits defined by reference to the benchmark index such as tracking error) as well as the narrowness of the investment universe. In this context UCITS may, when necessary for investor understanding, also disclose quantitative metrics (e.g. precise internal limits on tracking error etc.).

Unless stricter requirements specific to a Member State apply, UCITS which are actively managed in reference to a benchmark index are not required to numerically quantify the degree of freedom by outlining for instance expected tracking error, active share, or other metrics in order to provide a quantitative indication. However, where the UCITS management company believes such information will assist investor understanding, it may do so by providing explanations in language sufficiently comprehensible to retail investors.

Some examples of wording that is likely to be acceptable when indicating the degree of freedom from the benchmark index in the KIID can be found below. These examples are for illustrative purposes only and are non-exhaustive:

- Regarding point 1) above: “The majority of the Sub-Fund’s equity securities will be components of and have similar weightings to the Benchmark. The Investment Manager may use its discretion to invest in companies or sectors not included in the Benchmark in order to take advantage of specific investment opportunities.”

- Regarding point 2) above: “The investment strategy will restrict the extent to which the portfolio holdings may deviate from the ABCD index. This deviation may be [limited]/[material]/[significant]. This is likely to limit the extent to which the Sub-Fund can outperform the ABCD Index. Deviations from the ABCD index are limited by a target tracking error of [X] [accompanied by a clear, concise description of the quantitative indicator’s meaning]”.

Where a UCITS has a defined strategy to vary the risk it will take against an index, this should be disclosed. For example, where a UCITS is structured in order to be managed in alignment with an index during periods of market volatility, it should disclose this. This does not imply that the KIID should be updated to reflect very short-term / one-off variations in the investment strategy during a UCITS lifecycle, as long as the capacity for such variations has been previously disclosed.

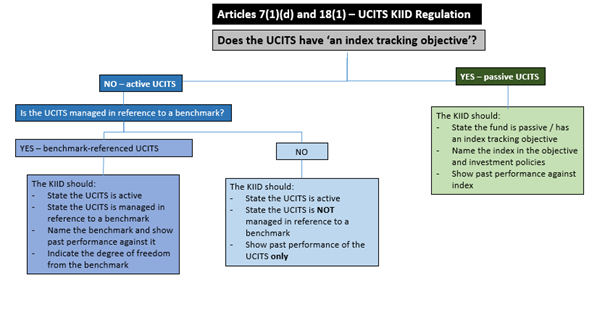

This information is summarised in the following graphic.

UCITS management companies should make any changes to the KIID in order to incorporate this additional guidance as soon as practicable, or by the next KIID update following the publication of this Q&A.

In accordance with Article 79(1) of the UCITS Directive and to ensure fair, clear and not misleading communications, the information disclosed in the UCITS KIID should be consistent with the UCITS’ Investment Objective in the Prospectus