Original question

Original language

[ESMA 34-43-392 UCITS Q&A, section 2, Q&A 8b]

A UCITS managed in reference to a benchmark index is one where the benchmark index plays a role in the management of the UCITS, for example, in the explicit or implicit definition of the portfolio’s composition and/or the UCITS’ performance objectives and measures. This reference may be present at the outset of a UCITS’ existence, or may be introduced during its lifecycle; in both cases it should be disclosed. Ultimately, the onus is on the UCITS management company to identify whether the UCITS is in practice managed in reference to a benchmark index. However, the following are (non-exhaustive and non-cumulative) examples of where an approach may include or imply reference to a benchmark index and where a UCITS should disclose that it is managed in reference to that benchmark index:

Portfolio composition

- The UCITS uses a benchmark index as a universe from which to select securities. This applies even if only a minority of securities listed in the index are held in the portfolio and the weightings of the UCITS’ portfolio holdings diverge from their equivalent weighting in the index.

- The UCITS portfolio holdings are based upon the holdings of the benchmark index. For example:

- The individual holdings of the UCITS’ portfolio do not deviate materially from those of the benchmark index.

- Monitoring systems are in place to limit the extent to which portfolio holdings and/or weightings diverge from the composition of the benchmark index.

- The UCITS invests in units of other UCITS or AIFs in order to achieve similar performance to a benchmark index.

Performance measures

- Performance fees are calculated based on performance against a reference benchmark index.

- The UCITS has an internal or external target to outperform a benchmark index.

- Contracts between the management company and third parties, such as the Investment Management Agreement covering delegation of investment management, or between the management company and its directors and employees, state that the portfolio manager must seek to outperform a benchmark index.

- The individual portfolio manager(s) receive(s) an element of performance-related remuneration based on the fund’s performance relative to a benchmark index.

- The UCITS is constrained by internal or external risk indicators that refer to a benchmark index (e.g. tracking error limit, relative VaR for global exposure calculation).

- Marketing issued by the UCITS management company to one or more investors or potential investors shows the performance of the fund compared with a benchmark index.

For clarity, a benchmark index may refer to an individual index or composite index comprised of more than one index / a basket of indices.

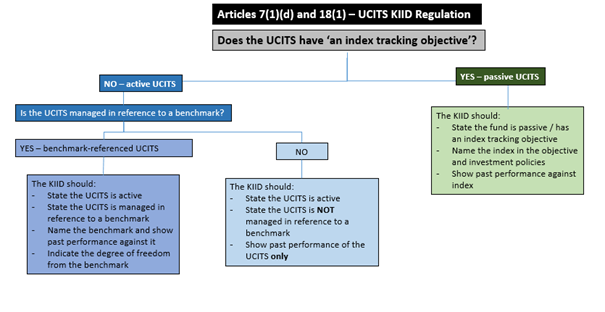

This information is summarised in the following graphic.

To assist investor understanding, it is recommended that UCITS which are not managed in reference to a benchmark index also make this clear to investors.

UCITS management companies should make any changes to the KIID in order to incorporate this additional guidance as soon as practicable, or by the next KIID update following the publication of this Q&A.

In accordance with Article 79(1) of the UCITS Directive and to ensure fair, clear and not misleading communications, the information disclosed in the UCITS KIID should be consistent with the UCITS’ Investment Objective in the Prospectus.