Original question

Original language

[ESMA 34-43-392 UCITS Q&A, section 2, Q&A 8a]

Yes. Article 7(1)(d) requires that a UCITS either has an index tracking objective, or alternatively allows for discretionary choices, and in both cases this must be disclosed in the objectives and investment policy section of the KIID.

In the case of index-tracking UCITS, using the terms ‘passive’ or ‘passively managed’ in addition to ‘index-tracking’ is recommended practice in order to assist investor understanding. A UCITS management company should consider providing additional wording to ensure the meaning of the term ‘passive’ or ‘passively managed’ is clear. An index-tracking (passive) UCITS must disclose the index it is tracking and show performance against that index in the past performance section of the KIID.

An actively managed UCITS is one where the manager has discretion over the composition of its portfolio, subject to the stated investment objectives and policy. As opposed to a passive UCITS, an active UCITS does not have an index-tracking objective although it may include or imply reference to a benchmark. A spectrum exists regarding the level of discretion active UCITS may wish to take or be permitted to take against a benchmark index. Some active UCITS take a lower level of risk against a benchmark index than others, and some are managed without any reference to a benchmark index at all.

Nevertheless, just as there is a requirement under the KIID Regulation to identify a UCITS that is index-tracking (passive), it should be equally clear to investors where the UCITS is actively managed. Explicitly using the terms ‘active’ or ‘actively managed’ is recommended practice in order to assist investor understanding, and a UCITS management company should consider providing additional wording to ensure the meaning of the term ‘active’ or ‘actively managed’ is clear.

Active UCITS which are managed in reference to an index must provide additional disclosure on the use of the benchmark index (Article 7(1)(d)) and show past performance against it (Article 18(1)). They must also indicate the degree of freedom from the benchmark (see Q&A 8c). Article 18(1) requires active UCITS managed in reference to a benchmark index to display past performance against that benchmark.

It should be clear which benchmark index (or indices) the UCITS is tracking or is being managed in reference to. Where more than one version of a benchmark index is published (for example a total return version, price return version, etc.), it should be clear which version is being used by the UCITS.

To assist investor understanding, it is recommended practice that active UCITS which are not managed in reference to any benchmark should also make this clear to investors (see Q&A 8b).

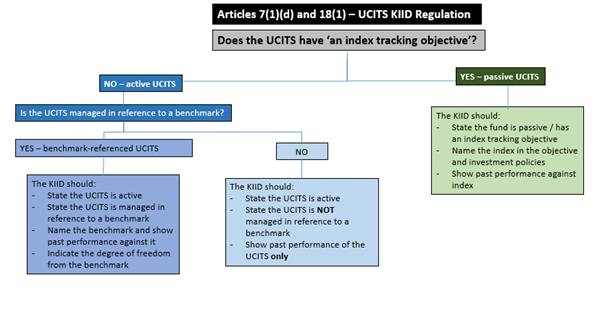

This information is summarised in the following graphic.

UCITS management companies should make any changes to the KIID in order to incorporate this additional guidance as soon as practicable, or by the next KIID update following the publication of this Q&A.

In accordance with Article 79(1) of the UCITS Directive and to ensure fair, clear and not misleading communications, the information disclosed in the UCITS KIID should be consistent with the UCITS’ objectives and investment policy in the Prospectus.