Cost of Investment Products

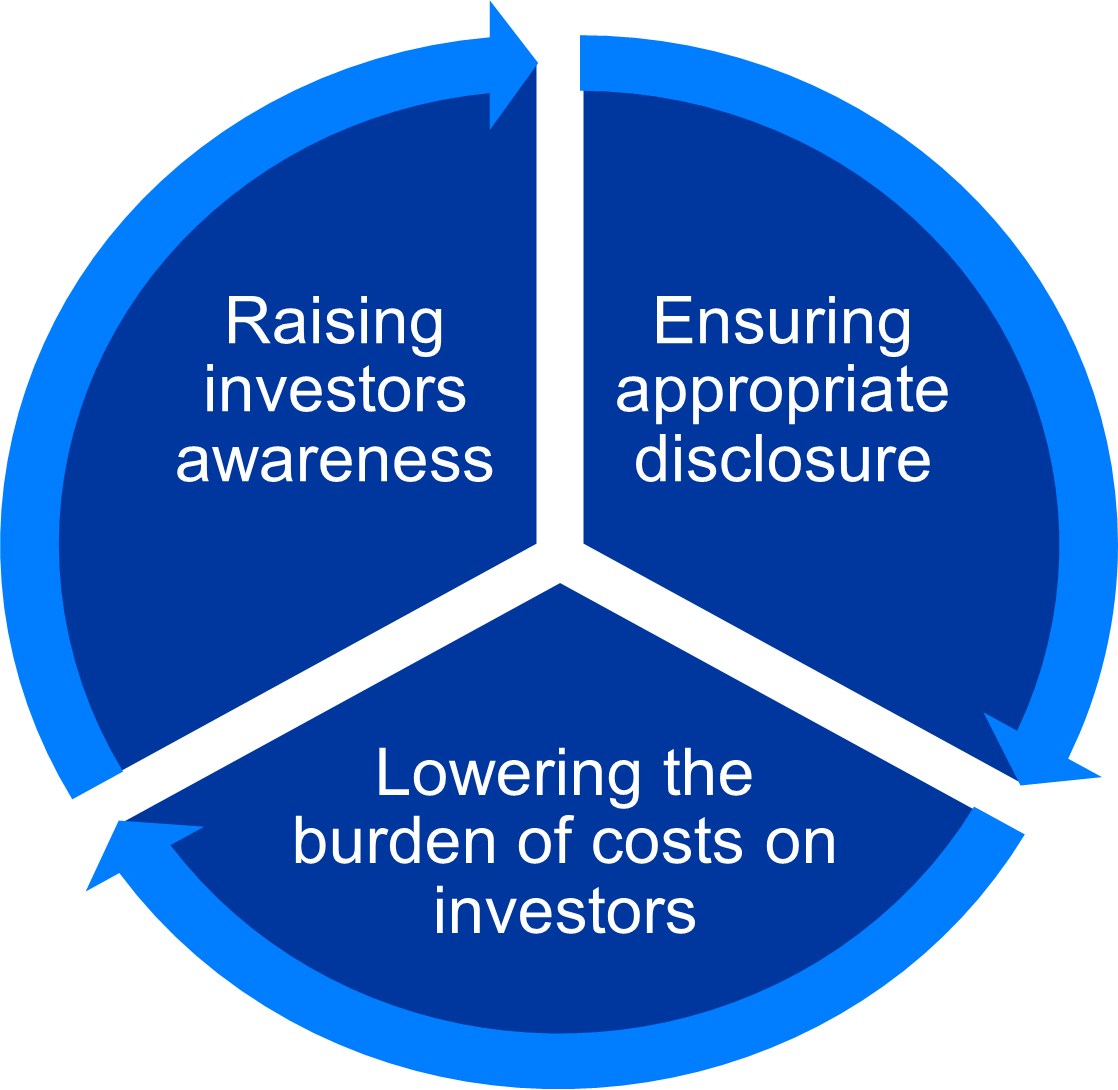

The availability of well-designed and cost-efficient products is a key element to encourage increased consumer participation in the European capital markets. ESMA aims to better serve financial consumers’ needs and to reinforce their ability to make informed choices.

ESMA does this by:

primary_grey_background

white_background

main_blue_background

ESMA’s work on the cost of investment products is informed by:

white_background

work with NCAs and consumer associations

white_background

market trends

white_background

economic analysis

white_background

ESMA focuses on:

primary_grey_background

Investment Funds

Benchmark Disclosure

- What is it? UCITS should clearly indicate whether their strategy is ‘active’ (or ‘actively managed’) or ‘passive’ (or ‘passively managed’) and disclose the reference benchmark.

- What does ESMA do? Public Statement on potential closet index tracking | Benchmark disclosure Q&As

Performance fees

- What is it? Lack of harmonisation of performance fee models among Member States and risk of divergent levels of investors protection.

- What does ESMA do? Guidelines on performance fees | UCITS Q&As and AIFMD Q&As

Supervision of costs

- What is it? Lack of convergence on the way the notion of “undue costs” is interpreted across the EU and on the supervisory approach to the cost-related provisions.

- What does ESMA do? Supervisory briefing on the supervision of costs in UCITS and AIFs | Common Supervisory Action (CSA) on the supervision of costs and fees with NCAs: CSA Final Report | Opinion on undue costs of UCITS and AIFs

white_background

primary_grey_background

Economic Analysis

Market Reports

- What is it? The Costs and Performance of EU Retail Investment Products is an analysis of cost and past performance of investment products, a key element in ESMA’s investor protection mandate and in its financial market surveillance and risk analysis.

- What does ESMA do? ESMA issues yearly reports as part of its risk monitoring activity. The last edition shows that costs of investing in the most important retail financial products continued to decline and that the availability of well-designed and cost-efficient products is crucial for investors benefits and market confidence.

Closet indexing

- What is it? A fund sold as if it was actively managed while in reality the management style is closer to a passive fund.

- What does ESMA do? Cost and Performance of Potential Closet Index Funds | Trends, Risk and Vulnerabilities (see Closet Index Indicator in the Statistical Annex)

Trend and Risk Monitoring: Consumers

- What is it? Assessment on consumer trends and risks that can be detrimental for consumers.

- What does ESMA do? ESMA publishes the TRV report twice a year with a section focused on Consumers. Main risk drivers identified: high market uncertainty and inflation risk; aggressive marketing techniques and exposure to riskier products and trading frauds; poor disclosure of costs.

Financial Products

- What is it? Retail risk monitoring aiming to provide policymakers and supervisors with the information they need to better protect investors. The set of Retail Risk Indicators should aim to reflect market developments, especially the rise of online- or mobile-based retail trading.

- What does ESMA do? ESMA published the analysis on Key Retail Risk Indicators for the EU single market.

white_background

primary_grey_background

MiFID

Information to clients on costs and charges

- What is it? Harmonisation of the way information on costs and charges of products and services is disclosed to (retail) clients.

- What does ESMA do? Q&As | CSA and mystery shopping

Suitability assessment

- What is it? Assessment of cost and complexity of equivalent products as part of the suitability assessment performed for advisory services.

- What does ESMA do? Q&As | Guidelines | CSA

Product governance

- What is it? Assessment of compatibility of product costs structure with the target market.

- What does ESMA do? Q&As | CSA

white_background

primary_grey_background

Next steps

- Economic analysis and monitoring of consumer trends and risks for consumers.

- Continuing work on costs and performance of retail investment products.

- Facilitating discussions among NCAs on the supervision of costs in investment funds.

white_background

primary_grey_background

primary_grey_background