Risk Monitoring

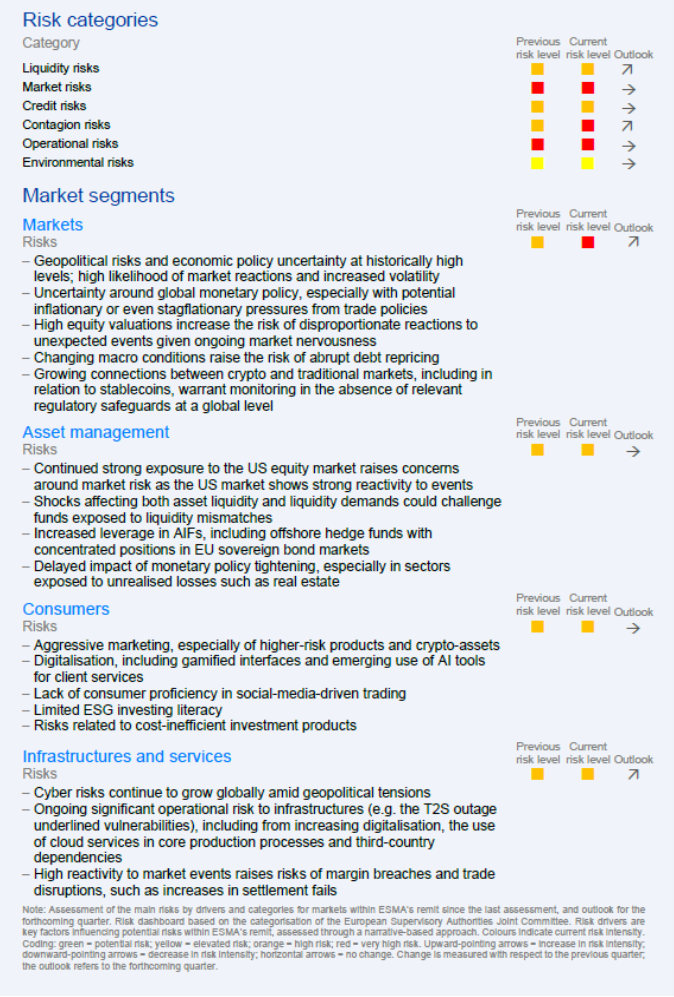

Risk assessment focuses on important market risks that could harm ESMA’s objectives of investor protection, orderly markets and financial stability.

ESMA monitors and assesses developments in the area of its competence and, where necessary, informs the European Parliament, the Council, the Commission, the other European Supervisory Authorities and the ESRB on a regular and, as necessary, on an ad hoc basis. ESMA continuously strengthens its capabilities to identify and assess risks to investors, orderly markets and financial stability in the EU.

ESMA monitors and assesses developments in the area of its competence and, where necessary, informs the European Parliament, the Council, the Commission, the other European Supervisory Authorities and the ESRB on a regular and, as necessary, on an ad hoc basis. ESMA continuously strengthens its capabilities to identify and assess risks to investors, orderly markets and financial stability in the EU.

ESMA’s risk assessments and risk monitoring are published in a series of reports such as the Trends, Risks and Vulnerabilities report, the Risk Dashboard and the Market Reports series.

Trends, Risks and Vulnerabilities

Twice a year, ESMA produces the Trends, Risks and Vulnerabilities report – Risk Monitor (TRV Risk Monitor report) highlighting market developments, identifying market trends and comparing them over time and across markets. The Risk part is an analysis based on ESRB/ESA categories.

The TRV Statistical Annex provides an extensive and up-to-date charts and tables with key data on the markets under ESMA’s remit.

The TRV Structural Market Indicators (SMI) provide structural indicators on securities, markets, market participants and infrastructures for the EEA, EU and by Member State. The TRV SMI shows data from registers maintained by ESMA, based on information submitted by National Competent Authorities or market participants.

ESMA also takes part in the production of the ESA Joint Committee’s Report on Risks and Vulnerabilities in the EU Financial System which focuses mainly on cross-sectoral risks.

Latest version:

Risk Dashboard

This previous independent publication is discontinued since 2021.

ESMA Market Reports

ESMA's Market Reports

ESMA's risk assessment draws on data and statistics sourced and managed through an integrated approach, ensuring high quality, efficient management and effective use. This is particularly the case for the proprietary data that ESMA collects. As part of this integrated approach we have established a Market Reports series. These reports complement ESMA’s ongoing market monitoring through the TRV report and the Risk Dashboard.

In its Markets Reports series, ESMA currently covers:

- EU carbon markets,

- EU Credit Ratings market,

- EU MMF market,

- EU derivatives markets, based on EMIR data,

- EU prospectuses,

- EU securities markets, based on MiFID II/MiFIR data,

- EU alternative investment funds, drawing on AIFMD data,

- cost and past performance of long-term retail investment products (UCITS, retail AIFs and structured retail products), and

- total costs of investing in UCITS and AIFs.

Alternative investment funds

- EU Alternative Investment Funds 2023

- ASR on EU Alternative Investment Funds - 2022

- ASR on EU Alternative Investment Funds - 2021

- ASR on EU Alternative Investment Funds - 2020

- ASR on EU Alternative Investment Funds - 2019

EU Carbon markets

EU Credit Ratings market

EU Crowdfunding

EU MMF market

EU derivatives markets

- EU Derivatives Markets - 2023

- ASR on EU derivatives markets - 2021

- ASR on EU derivatives markets - 2020

- ASR on EU derivatives markets - 2019

- ASR on EU derivatives markets - 2018

EU Securities Financing Transactions markets

Performance and cost of retail investment products

- Costs and Performance of EU Retail Investment Products - 2025 | Annexes

- Costs and Performance of EU Retail Investment Products - 2024 | Annexes

- Costs and Performance of EU Retail Investment Products - 2023 | Annexes

- ASR on the performance and cost of retail investment products - 2023 | Annexes

- ASR on the performance and cost of retail investment products - 2022

- ASR on the performance and cost of retail investment products - 2021

- ASR on the performance and cost of retail investment products - 2020

- ASR on the performance and cost of retail investment products - 2019

Prospectuses

Securities Markets

- EU Securities Markets - 2023

- ASR on EU securities markets - 2021

- ASR on EU securities markets - 2020