Listing Act

The Listing Act aims to simplify the listing rules for companies that want to list on public stock exchanges, while also preserving transparency, investor protection and market integrity. It seeks to counter the fragmentation of national laws that restrict the flexibility of companies to issue multiple-vote shares when going public, which is particularly important for innovative scale-ups.

Proposed by the European Commission in 2022, the Listing Act is a package of measures meant to review the Prospectus Regulation, Market Abuse Regulation, Markets in Financial Instruments Regulation and Directive (MiFIR/MiFID II), and to introduce a new Directive on multiple-vote share structures. In that context, the following regulations and directives were published in the Official Journal on 14 November 2024 (i) Regulation (EU) 2024/2809 (ii) Directive (EU) 2024/2810 (iii) Directive (EU) 2024/2811

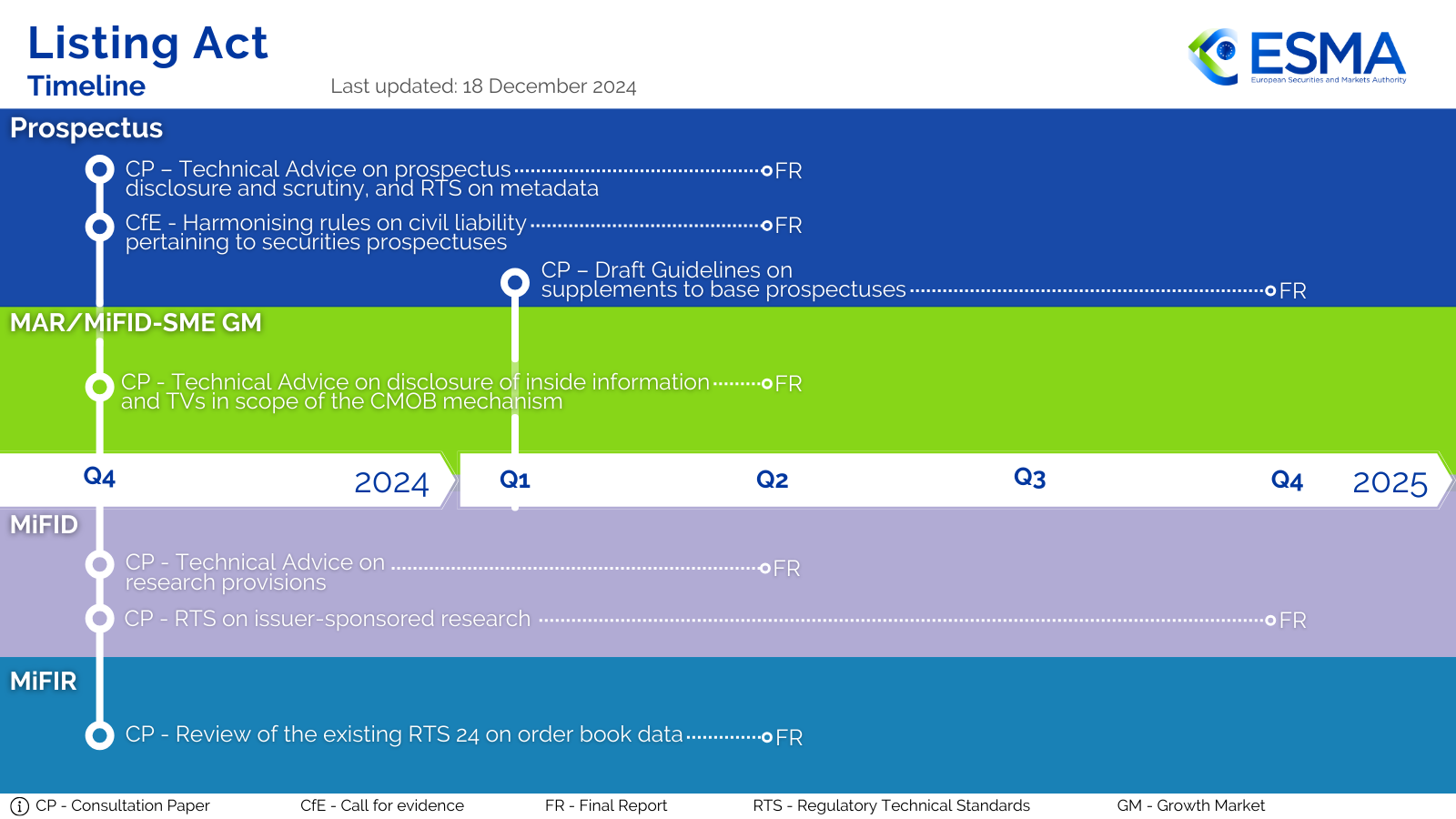

To facilitate the effective implementation of the Listing Act, ESMA will be publishing a series of consultation papers and final reports, with respect to each legislative area, to identify the necessary changes to meet its goals. The consultation papers will be in response to technical advice requested from the European Commission as well as direct empowerments to issue or update regulatory and implementing technical standards and guidelines.

Commission request for advice

Prospectus

Consultation Papers

Consultation Paper on draft technical advice concerning the Prospectus Regulation and on updating the CDR on metadata

This Consultation Paper (‘CP’) relates to the Commission’s request for technical advice concerning the Prospectus Regulation. It contains several sections which address the following elements of the request:

- content and format of the full prospectus, including a building block of additional information to be included in prospectuses for non-equity securities offered to the public or admitted to trading on a regulated market that are advertised as taking into account ESG factors or pursuing ESG objectives; and

- criteria for the scrutiny and the procedures for the approval of the prospectus, including proposed amendments to Commission Delegated Regulation 2019/980 or ‘CDR on scrutiny and disclosure’.

This CP is also being used to consult on changes to Commission Delegated Regulation 2019/979, which relate to the data for the classification of prospectuses. These proposed changes are considered necessary to properly implement the Prospectus Regulation, as amended by the Listing Act, taking into account (i) the fact that there will be new types of prospectuses under the Listing Act (ii) prospectuses for European Green Bonds (iii) interaction with ESAP and (iv) the need to enhance data collection.

Consultation Paper on draft Guidelines specifying the circumstances in which a supplement is to be considered to introduce a new type of security into a base prospectus

These draft Guidelines seek to facilitate competent authorities and financial market participants in identifying when a supplement is to be considered as introducing a new type of security that is not already described in a base prospectus.

Final Reports

Final Report on technical advice concerning the Prospectus Regulation and the RTS updating the CDR on metadata

This Final report contains:

- advice relating to the content and format of prospectuses;

- proposed disclosure annexes for non-equity securities that are advertised with ESG features;

- advice relating to the scrutiny of information in prospectuses as well as advice relating to the procedures for the approval of a prospectus; and

- proposals to updates to the data reporting requirements in line with changes introduced by the Listing Act and in relation to the implementation of ESAP.

The Final report was prepared based on feedback to the Consultation Paper on draft technical advice concerning the Prospectus Regulation and on updating the CDR on metadata.

Other publications

Call for evidence on potential further steps towards harmonising rules on civil liability pertaining to securities prospectuses under the Prospectus Regulation

The Listing Act says that further harmonisation of rules on prospectus liability should be contemplated, and the European Commission should deliver a report on this to the European Parliament and the Council. The European Commission has called upon ESMA to provide advice to it in this context.

The aim of the Call for Evidence is to get feedback from market participants on a number of basic questions regarding civil liability for information given in prospectuses and provide advice to the European Commission on that basis.

MAR / MiFID-SME Growth Market

Consultation Papers

CP on the disclosure of inside information in a protracted process, on situations of contrast between inside information to be delayed and the issuer's latest communications and on the requirements to be registered as an SME GM under Article 33 of MiFID II

This CP covers several mandates:

- Draft technical advice on the

- i) final events or circumstances in protracted processes and relevant moment of disclosure and

- ii) situations where there is a contrast between inside information to be delayed and the issuer's latest public announcement or communication.

ESMA is also requested to provide information concerning trading venues part of the CMOB mechanism to exchange order data.

- Draft technical advice on the requirements necessary for an MTF or a segment thereof to be registered as an SME growth market, ensuring such requirements minimise the administrative burdens for the issuers on those markets while taking into account the need to maintain high levels of investor protection and confidence in those markets

Consultation on the Draft implementing technical standards on the extension of the use of the alleviated format of insider lists

This consultation paper proposes changes to the format for drawing up and updating insider lists, as part of the Listing Act amendments to the Market Abuse Regulation (MAR). The Listing Act mandates ESMA to review the Implementing Technical Standards (ITS) on insider lists to extend the simplified format - currently used by issuers on Small and Medium Enterprises (SME) Growth Market - to all issuers.

Final Reports

MiFID provisions on research

Consultation Papers

CP on the Technical Advice to the EC on amendments to the research provisions in the MiFID II Delegated Directive

The amended article 24(9a) MiFID introduces a new payment regime for research and execution services. The research provisions in the MiFID II Delegated Directive should be amended to reflect this new payment option.

CP on the RTS on issuer-sponsored research

’The new article 24(3c) MiFID introduced by the Listing Act requires ESMA to develop an RTS to establish an EU code of conduct for issuer-sponsored research. Investment firms shall ensure that the research they distribute to clients or potential clients and that is labelled as ‘issuer-sponsored research’ is produced in compliance with the EU code of conduct for issuer-sponsored research. The code of conduct shall set out standards of independency and objectivity, and specify procedures and measures for the effective identification, prevention and disclosure of conflicts of interest.

MiFIR

Consultation Papers

CP on the Review of the existing RTS 24 on order book data

The review of RTS 24 falls within the context of the revision of MiFIR Article 25 (more details on the MIFIR review webpage), which mandates ESMA to specify the format for reporting order book data under RTS 24. The proposed changes aim to enhance data reporting standards and ensure more effective oversight of trading activity.

Updates include the introduction of a machine-readable format to fulfil the European Commission’s mandate and aligning data elements with RTS 22. Additional improvements refine the list of details in the Annex by adding new optional fields and making minor adjustments to existing ones.