Markets in Crypto-Assets Regulation (MiCA)

The Markets in Crypto-Assets Regulation (MiCA) institutes uniform EU market rules for crypto-assets. The regulation covers crypto-assets that are not currently regulated by existing financial services legislation. Key provisions for those issuing and trading crypto-assets (including asset-reference tokens and e-money tokens) cover transparency, disclosure, authorisation and supervision of transactions. The new legal framework supports market integrity and financial stability by regulating public offers of crypto-assets and by ensuring consumers are better informed about their associated risks.

MiCA Implementing Measures

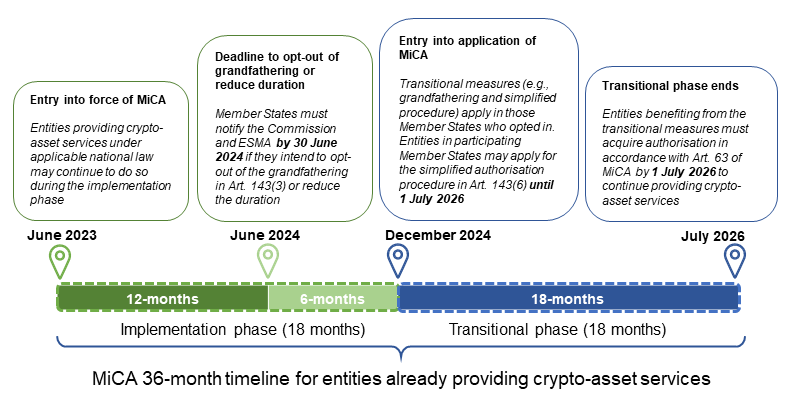

The Markets in Crypto Assets Regulation (MiCA) entered into force in June 2023. The regulation includes a substantial number of Level 2 and Level 3 measures that must be developed before the entry into application of the new regime (within a 12-to-18-month deadline depending on the mandate).

During the implementation phase of MiCA, ESMA (in close cooperation with EBA, EIOPA, and the ECB) consulted with the public on a range of technical standards that will be published sequentially in three packages. The aim was to deliver draft level 2 and 3 measures that incorporated feedback from the public. Most of these measures have entered into application following the adoption by the European Commission and approval by the European Parliament and the Council of the EU. A compilation of level 2 and level 3 measures can be found in this table:

Interim MiCA Register

The latest version can be downloaded through the following links:

↓ White papers for crypto-assets other than ART and EMT

↓ White papers for crypto-assets other than ART and EMT- ↓ Issuers of ART

- ↓ Issuers of EMT

- ↓ Crypto-asset service providers

- ↓ Non-compliant entities

Last update: 13 February 2026

The crypto-asset white papers listed in ESMA’s register have not been reviewed or approved by any competent authority in any Member State of the European Union. The offeror and/or issuer of the crypto-asset is solely responsible for the content of each crypto-asset white paper.

About Interim MiCA Register

About: Interim MiCA Register

Articles 109 and 110 of the MiCA Regulation empower ESMA to publish a central register of crypto-asset white papers, authorised crypto-asset service providers, and non-compliant entities by 30 December 2024. The information displayed in the register is to be provided to ESMA by the relevant National Competent Authorities (NCAs) and the European Banking Authority (EBA).

To meet the legal deadline, ESMA has prepared an interim MiCA register which will be updated and (re)published at regular intervals. The interim MiCA register will be available on this MiCA webpage (and on the Databases and Registers webpage) as a collection of csv files until mid-2026 when it will be formally integrated into ESMA’s IT systems.

The interim MiCA register consists of five csv files:

- White papers for crypto-assets other than asset-referenced tokens and e-money tokens (Title II);

- Issuers of asset-referenced tokens (Title III);

- Issuers of e-money tokens (Title IV);

- Authorised crypto-asset service providers (Title V);

- Non-compliant entities providing crypto-asset services.

Update frequency

Please note that ESMA will publish the latest version of the register on weekly intervals. As such, information that may be reported to ESMA by competent authorities or listed in a national register will not be immediately displayed.

Information on the records displayed in the interim MiCA register

Records displayed in each of the five interim MiCA register files reflect information received by the authorising (or notified) competent authority. In case an authorisation is withdrawn by the competent authority, this record will remain in the publication with the information on the date in which this withdrawal was effective. Further detail on how to interpret the information and formats for each field are available in the following file:

Information on MiCA data standards and white paper formatting requirements

MiCA and its associated implementing regulations set out the technical format requirements for crypto-asset white papers and for the order book records to be kept by crypto-asset service providers operating a trading platform. It also sets out the data standards applicable to record-keeping by certain crypto-asset service providers whose services involve placement of orders or execution of transactions.

For an overview of all MiCA data standards and formatting requirements, see the ESMA statement published on 28 November 2025:

▸ Statement to support the smooth implementation of MiCA standards and format

The purpose of these requirements is to ensure transparency, facilitate market surveillance and allow for the comparability of information across crypto-asset market participants.

MiCA order book and record keeping

To support compliance by crypto-asset service providers with MiCA’s order book and record keeping obligations, the records are to be provided in a consistent and comparable manner. As such, ESMA is making available a standardised, machine-readable JSON schema for all orders and trades. Using these standardised messages ensures a uniform data structure and transaction metadata, enabling consistent reporting and seamless data exchange with competent authorities.

Considering the need to ensure an orderly transition to the new standards and format of order book records, NCAs expect to start requesting data in the new JSON file format within 6 months after its official publication on ESMA's website (on 28 November 2025) at this link:

MiCA white paper formatting requirements

Proper disclosures are essential for safeguarding investors by allowing them to make informed decisions about a given crypto-asset. Under MiCA, these disclosures take the form of a white paper.

At the following links, ESMA provides stakeholders and preparers of crypto-asset white papers with the information they need to comply with the iXBRL format requirement to ensure that the information in the white paper is machine-readable and consistent with the relevant MiCA technical standards.

To showcase the generation of an iXBRL white paper, ESMA is also making a set of Excel-based examples (one for each type of crypto-asset) available to the public. Use of this showcase is voluntary, and ESMA will not accept any liability concerning its use or its outputs, which need validation and remain under the full responsibility of the preparer of the crypto-asset white paper.

The MiCA white paper formatting requirements, including the use of iXBRL format, entered into application on 23 December 2025. ESMA published the associated XBRL taxonomy on 5 August 2025. See below:

▸MiCA White Paper Taxonomy 2025

Related documents:

Annex – Example of Excel-based solution to generate White Papers in iXBRL

Supervisory Convergence in the MiCA Transitional Phase

In parallel to the drafting of technical standards, ESMA is working with the national competent authorities (NCAs) on a convergent approach to authorisations of crypto-asset service providers (CASPs) during the transitional phase.

The purpose of this supervisory convergence work is to ensure alignment on supervisory expectations related to entities offering crypto-asset services across EEA jurisdictions in the transitional period of MiCA and to promote, from the outset, consistent practices to be used after the entry into application of MiCA, starting with the authorisation regime.

More background on MiCA transitional measures

Member States will have the option of implementing ‘transitional measures’ (Article 143 of MiCA) that would allow entities or undertakings already providing crypto-asset services under applicable law in their jurisdictions to continue doing so during the transitional phase of MiCA (i.e., the period of 18-months after full application in December 2024). These transitional measures include:

- A ‘grand-fathering’ clause Art. 143 (3) – allowing entities providing crypto-asset services in accordance with national applicable laws before 30 December 2024 to continue to do so until 1 July 2026 or until they are granted or refused a MiCA authorisation.

- A simplified authorisation procedure Art. 143 (6) – for entities that were already authorised under national applicable law on 30 December 2024 to provide crypto-asset services.

ESMA workplan

During the transitional phase, a mix of regimes (e.g., MiCA or existing bespoke regimes) will coexist across Member States, which may result in disparate levels of protection for consumers of crypto-asset services. To overcome these challenges, ESMA is promoting supervisory convergence between Member States in three ways:

- Providing a forum where supervisors from the NCAs can exchange views on practical cases in their jurisdictions, as well as identifying best practices to promote convergence.

- Mapping the current landscape for entities providing crypto-asset services among Member States and surveying how each jurisdiction intends to approach the optional transitional measures.

- Engaging in ongoing consultations with the Commission to provide the basis for a common understanding (as early as possible) on MiCA provisions that might require further clarity.

Information regarding notification requirements for Member States

Member States notification requirements

| Member States are subject to certain notification requirements to EBA and ESMA under MiCAR: | ||

|---|---|---|

| Subject | Notification requirement | Deadline (if any) |

| Competent authorities (Article 93 MiCAR) | Member States are required to notify the designated competent authorities responsible for carrying out the functions and duties provided for in MiCAR. Where more than one competent authority is designated they need to determine their respective tasks and designate one competent authority as the single point of contact for cross-border administrative cooperation. | Once Member States have designated the competent authorities responsible for carrying out the functions and duties provided for in MiCAR. |

| Laws, regulations and administrative provisions implementing Title VII MiCAR (Article 99 MiCAR) | Member States are required to notify the laws, regulations and administrative provisions implementing Title VII MiCAR, including any relevant criminal law provisions, as well as any subsequent amendments thereto. | 30-Jun-25 |

| Rules for administrative penalties and other administrative measures (Article 111 MiCAR) | Member States are required to notify, in detail, the rules for administrative penalties and other administrative measures in relation to certain infringements and any subsequent amendment thereto. | 30-Jun-25 |

| Information on competent authorities' complaints handling procedures (Article 108 MiCAR) | Competent authorities are required to set up procedures that allow clients and other interested parties, including consumer associations, to submit complaints to them with regards to alleged infringements of MiCA. They are also required to communicate to EBA and ESMA information on these procedures. | |

| For further details on the official notification channel and notification template please refer to the following document. | ||