External Reviewers of European Green Bonds

External reviewers provide an independent opinion on whether an issuer of European Green Bonds complies with the Taxonomy requirements of the European Green Bonds Regulation. ESMA will be the direct supervisor of external reviewers of European Green Bonds within the EU, under Regulation (EU) 2023/2631 (‘European Green Bonds Regulation’).

To issue a European Green Bond, an issuer must use an external reviewer:

- before the issuance of a European Green Bond (‘pre-issuance review of European Green Bond factsheet') and;

- after the full allocation of its proceeds ‘(post-issuance review of allocation report’).

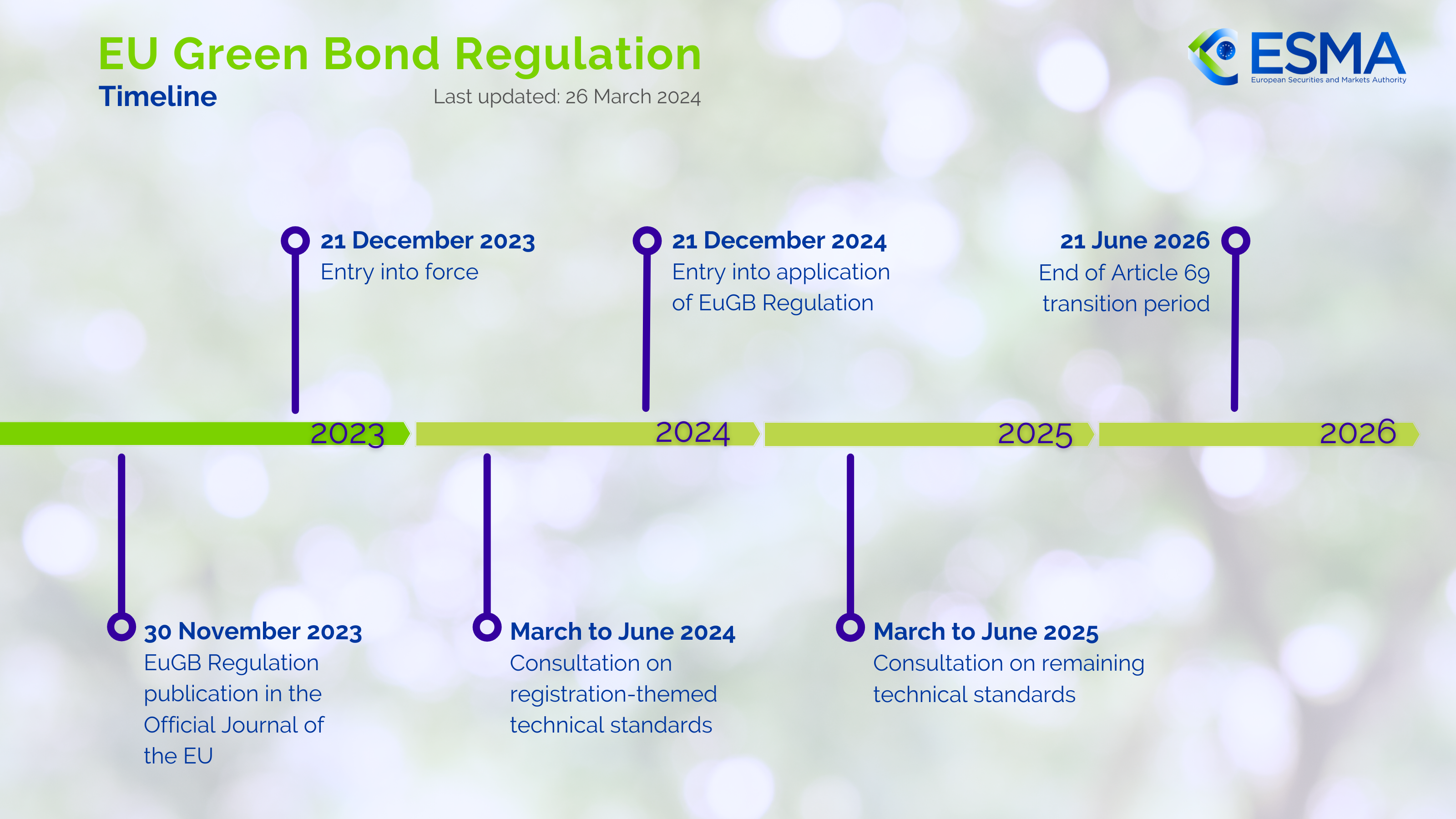

Registration required from 21 June 2026.

ESMA is responsible for the registration and supervision of external reviewers.

Regulation

The European Green Bonds Regulation was published in the Official Journal of the European Union on 30 November 2023.

The Regulation entered into force on 21 December 2023 and will apply 12 months after, on 21 December 2024, with the exception of the derogations outlined in Articles 72(3) and 72(4).

Registration

Firms wishing to provide external reviewer services under the EU Green Bond Regulation after 21 June 2026 must be registered with ESMA. Firms are encouraged to submit their applications as early as possible using the provided template. Applications should be submitted to extreviewreg@esma.europa.eu. ESMA will acknowledge receipt of the application within one working day. Applicants will be charged a registration fee of EUR 40,000, in accordance with Article 1(1) of the Commission Delegated Regulation (EU) 2025/755 of 16 April 2025. Further information on how ESMA processes applications can be found on our dedicated website.

Transitional regime

Notifications under the EU Green Bond Regulation

From 21 December 2024 until 21 June 2026 there will be a transitional period for firms to provide external review services for EU Green Bonds under the EU Green Bond Regulation (EU) 2023/2631. During this period, firms can provide external review services for EU Green Bonds after notifying ESMA and providing the information referred to in Article 23(1) of the EU Green Bond Regulation. External reviewers operating during the transition period should make their best efforts to comply with the requirements set out in Articles 24 to 38.

Information to provide

- the full name of the notifying external reviewer, the address of its registered office within the Union, the applicant’s website and, where available, the legal entity identifier (LEI);

- the name and contact details of a contact person;

- the legal form of the notifying external reviewer;

- the ownership structure of the notifying external reviewer;

- the identities of the members of the senior management and the board of the notifying external reviewer with their curriculum vitae showing at least their levels of qualification, experience and training;

- the number of the analysts, employees and other persons directly involved in assessment activities, and their level of knowledge, experience and training gained prior to and while working for the notifying external reviewer in the provision of external review or similar services;

- a description of the procedures and methodologies implemented by the notifying external reviewer to issue reviews;

- the corporate governance arrangements and the policies or procedures implemented by the notifying external reviewer to identify, eliminate or manage, and disclose in a transparent manner, any actual or potential conflicts of interest as referred to in Article 35;

- where applicable, documents and information related to any existing or planned outsourcing arrangements for activities of the external reviewer covered by this Regulation, including information on entities assuming outsourcing functions;

- where applicable, information about other activities carried out by the notifying external reviewer.

We ask firms to carefully review the below summary sheet before submitting their notification. This will help them to submit a complete set of documents.

Please send your notification to notifications_EUGB@esma.europa.eu.

ESMA publishes a list of firms that have notified ESMA and meet the obligations under Article 69 or Article 70 of Regulation (EU) 2023/2631.

Other firms have notified ESMA of their intention to provide External Reviews for European Green Bonds during the period from 21 December 2024 to 21 June 2026, pursuant to Article 69 or Article 70 of Regulation (EU) 2023/2631 of 22 November 2023.

The current list was updated on 13 February 2026. ESMA will update the list of firms as soon as practicable after receiving a notification that meets the obligation, and in any event, within 20 working days of receipt.

ESMA maintains the list to allow investors and issuers of EU Green Bonds to be informed of the firms that have notified ESMA and therefore can provide services as EU Green Bond External Reviewers during the transitional period.

Issuers, investors, external reviewers, and all other stakeholders should be clear that where an entity is included in ESMA’s list, this does not indicate that ESMA has registered or otherwise authorised or endorsed this entity. It indicates simply that the entities listed have notified ESMA pursuant to Articles 69 and 70 of the European Green Bond Regulation and provided the necessary information.

After the 18 months deadline, on 21 June 2026, external reviewers shall provide services only after they have been registered by ESMA.

To register as an external reviewer, ESMA will assess whether a firm meets the conditions set out in Article 23(1) of the Regulation on European Green Bonds based on the information provided by the applicant.

The specific timelines for both the completeness and the compliance phases are defined:

- For EU-based External Reviewers of EU GBs in Article 23 of the European Green Bond Regulation.

- For third-country External Reviewers of EU GBs in Article 42 of the European Green Bond Regulation.

ESMA is mandated to develop Regulatory Technical Standards (RTS) that will explain further the criteria used for assessing an application for registration by an external reviewer. ESMA will also produce Implementing Technical Standards (ITS) to outline the standard forms, templates and procedures for the submission of the information for registration. ESMA will consult on both the RTS and ITS. Information on these consultations are available on our website.

To receive further information on the registration process, please contact EUGB_queries@esma.europa.eu.

Non-EU External reviewers

The Regulation includes a third-country regime for non-EU external reviewers of EU Green Bonds.

The equivalence regime applies to external reviewers established in a non-EU country whose legal and supervisory framework has been recognised as equivalent through a decision adopted by the European Commission.

In the absence of an equivalence decision, an external reviewer with a legal representative established in the European Union, may apply for recognition as long as they comply with the requirements of the EU GB. ESMA will draft RTS specifying the information and the form and content required for applications for recognition to ESMA.

The endorsement regime is available for external reviewers established in the EU for endorsement of the services provided by a third-country external reviewer, provided that it is able to demonstrate to ESMA on an ongoing basis that the provision of services fulfils requirements which are, at least, as stringent as the requirements of the European Green Bonds Regulation, that it has the necessary expertise to effectively monitor and manage the associated risks and that the services of the third-country external reviewer are used for objective reasons.