Consolidated Tape Providers

The Markets in Financial Instruments Regulation review aims at creating the conditions for establishing consolidated tape providers (CTPs) for bonds, equities (shares and ETFs) and OTC derivatives. To appoint those CTPs, ESMA will be responsible for selecting the most suitable candidates on the basis of pre-defined criteria and subsequently authorising and supervising the CTPs.

This section will be updated regularly with public information on the selection procedures.

ESMA’s role in selecting CTPs

The Markets in Financial Instruments Regulation (MiFIR) provides a legislative framework for consolidated tape providers (CTPs). Those CTPs will be responsible for collecting from trading venues and approved publication arrangements (APAs) market data about financial instruments and for consolidating such data per financial instrument into a continuous electronic live stream made available to the public.

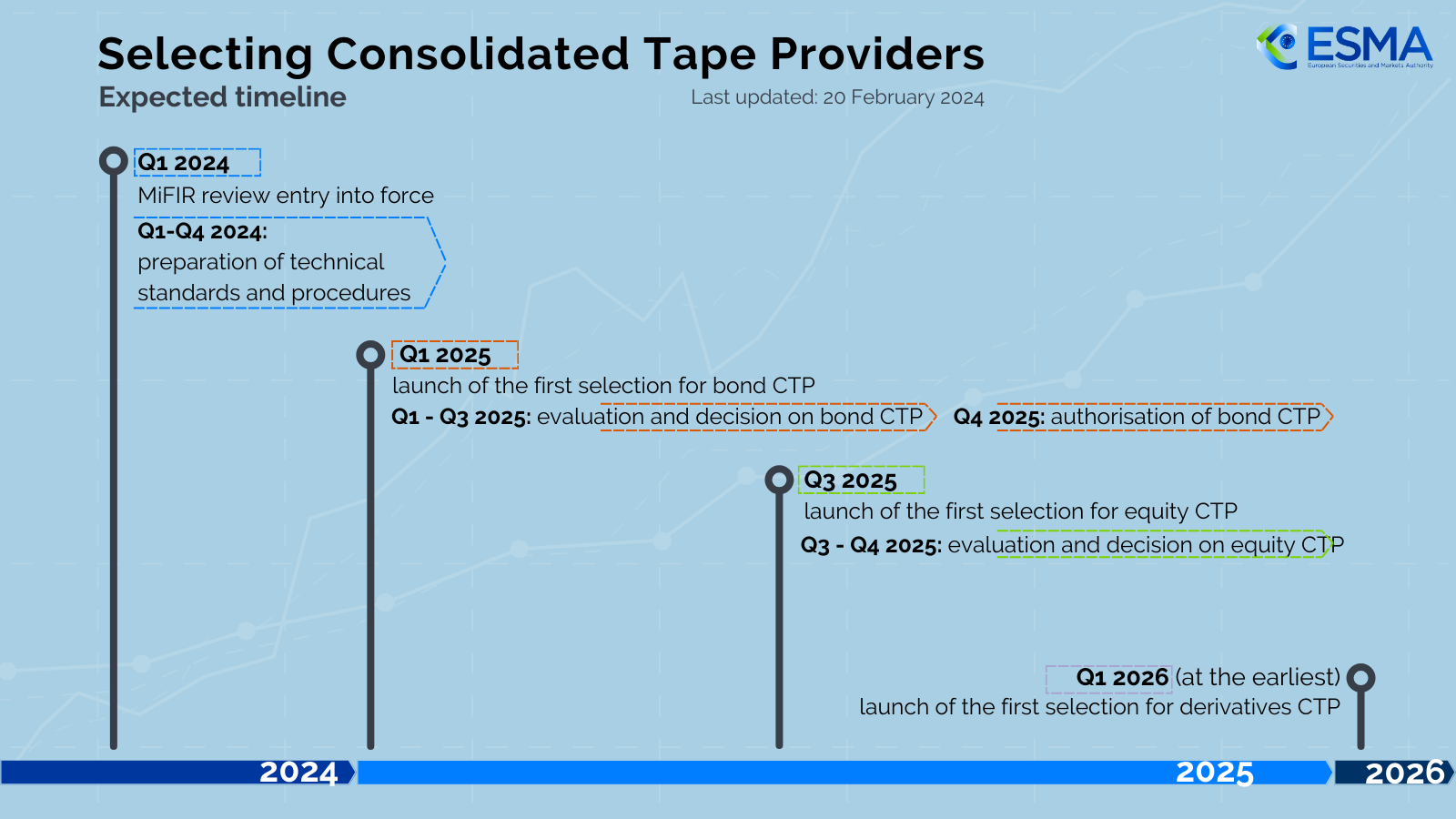

Upon entry into force of the amendments to MiFIR, ESMA will have nine months to organise the first selection procedure to award to a single entity the right to operate as a CTP for five years. A CTP will be authorised for each of the three asset classes: bonds, equity (shares and ETFs) and OTC derivatives (or relevant subclasses).

The selection procedures will be subject to the rules of the Regulation (EU, Euratom) 2018/1046 on the financial rules applicable to the general budget of the Union, with calls for tenders launched on a public platform. Each selection procedure will be finalised six months after its launch with a reasoned ESMA decision on the applicant deemed suitable for operating the consolidated tape. This entity will be invited to apply for authorisation without undue delay in a separate procedure.

Ahead of the launch of the first selection procedure for the bonds CTP expected by the end of 2024, ESMA will draft the technical standards of relevance to the CTP selection and prepare the selection documents. This preparatory phase may include a public consultation and stakeholder workshops, in strict respect of the principles of transparency and equal treatment between potential applicants.

Workshops

ESMA has organised two online workshops related to the CTPs selection procedures and the specification of selection criteria.

These workshops will provide relevant stakeholders with an initial understanding of ESMA’s approach to the selection of CTPs (across all asset classes) and with an opportunity to share their input before the launch of a more detailed consultation expected in May 2024.

Workshop on Consolidated Tapes for potential applicants

15 February 2024, 13:30-18:00 (Paris time)

- aimed at potential applicants to the CTP selection procedures

- focus: appropriate level of expectations for the success of the CTP selection procedures from the viewpoint of applicants

Workshop on Consolidated Tapes for market participants

14 March 2024, 09:00-13:00 (Paris time)

- aimed at a broader set of market participants

- focus: aspects to consider for the CTP to operate successfully from the viewpoint of data contributors and users

Contact form

Stakeholders interested in further understanding the CTP selection procedures are invited to submit their request for information via the dedicated contact form. Frequently asked questions (FAQs) will be published and regularly updated on this webpage.

Questions on the practical application or implementation of EU law and/or ESMA acts (such as Technical Standards and/or Guidelines) in the context of the CTPs should be submitted via the Q&A tool.